Partners

Health cover in France - A few definitions

A FEW DEFINITIONS

Understanding The French System:

Unlike the English system, the French regime makes no difference between the public and private treatments

(the reimbursement rates are identical).

On the other-hand, the 'Sécurité Sociale' alone does not cover the entirety of your expenses.

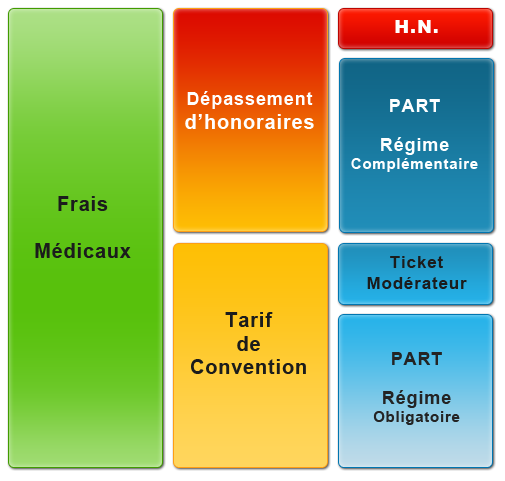

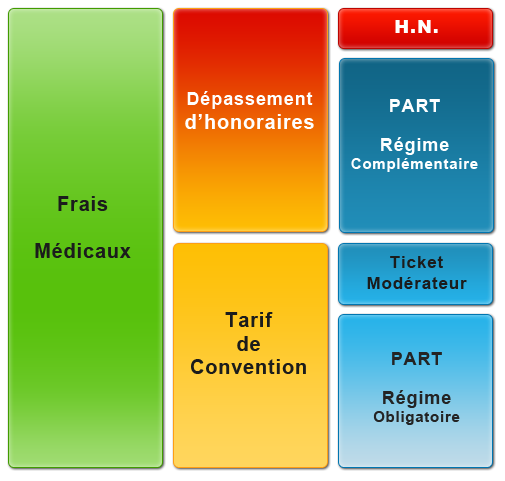

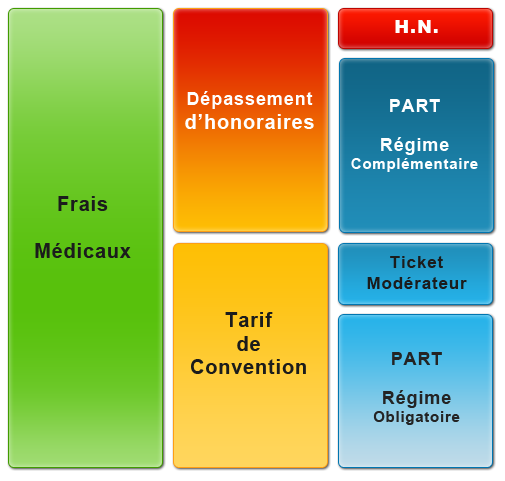

First column represents the total cost of your medical treatment.

Second column shows the possible reimbursements:

Orange = reimbursable with minimum cover

Orange to Red = Only reimbursable with higher cover or not at all.

Third column indicates where the reimbursements could come from.

Click on each column to see their individual definitions:

Frais Médicaux :

The TOTAL amount charged for your treatment.

This can be a Fixed rate or an amount announced by a specialist.

Dépassement d'honoraires :

Amount charged by a Doctor for time spent treating a patient.

A Doctor in "Secteur 1" will NOT charge over the"Tarif de Convention" and you will be totally reimbursed even on the lowest levels of Top-UP.

A Doctor in "Secteur 2" can charge over the "Tarif de Convention" and you will only be reimbursed if you have a higher level of "Top-Up".

You could be faced with "Dépassement d'honoraires" for a simple 15 minute specialist visit or for 4 hours of Major Surgery.

Rates charged must be communicated in advance, get in contact with the administration if not. .

Tarif de Convention :

Base rate given to medical treatment recognizable by a code that indicates its nature and tariff called “Nomenclature” fixed by the “CCAM”(Classification Commune des Actes Médicaux).

The “Tarif de Convention” fixes the 100% base rate that all medical professionals use but it does NOT limit their fees charged.

Top-Ups relate to the base rate and NOT to actual expenses. .

Ticket modérateur :

This represents the difference between your “Régime Obligatoire” reimbursements and the "Tarif de Convention".

This amount, normally reimbursed by a Top-Up will be reimbursed by your “Régime Obligatoire” in case of long-term illness, handicap or maternity.

The “100%” or the "TM" referred to on "Tiers Payant“ slips from Top-Ups will guarantee payment of the "Ticket Moderateur" to any professional accepting to use this facility without having to advance any money. .

Part Régime Obligaroire :

The Percentage of the "Tarif de Convention" that is covered by your “Régime Obligatoire”.

Usually these reimbursements come from "CPAM" or “RSI” if you are self employed.

Reimbursements range from 35% to 100% but are commonly referred to as 70% of the "Tarif de Convention".

Once fully into the French system you will receive a “Carte Vitale”.

This card replaces payment to medical professionals equipped with the “System Noemi”.

Part Régime Complémentaire :

"Part Mutuelle". This is the amount paid on your behalf by a Top-Up.

"Dépassement d'honoraires" can be reimbursed by a Top-Up.

Top-Ups starts at 100% and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICA’s sugests middle cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for the rest as some base rates are very low.

Hors Nomenclature:

These are treatments that are NOT included on the “CCAM” list thus they do not have a base rate.

These treatments are often in addition to ongoing treatment.

The “CCAM” tend to exclude preventative medicines, "Médecines douces“ that have not been accepted by the “Académie des Sciences”.

Some Top-Ups reimburse thing like osteopathy and homeopathy using Fixed rates set by the companies called “Forfait Annuel”.

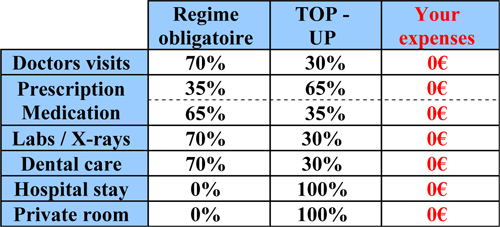

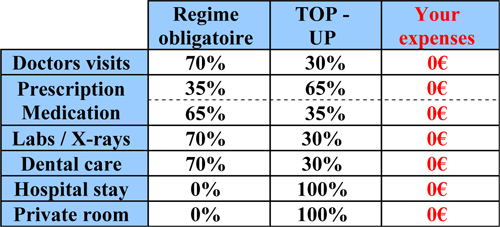

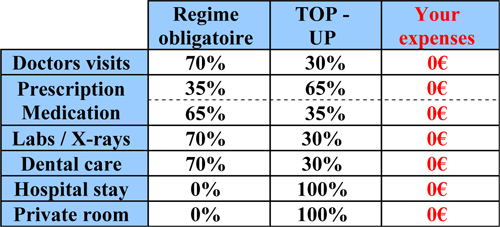

Examples of reimbursement:

SOFICAS clients benifit fully from the French system  as we use French companies that know thier subject.

as we use French companies that know thier subject.

"Télétransmition"

Automatic reimbursements using only your "Carte Vitale".

"Tiers Payant"

No money to be advanced at the chemist / lab / x-ray and more.

"Prise en charge"

Possible on demand even for Optical and Dentistry.

Hospitals stay expenses can be paid directly by your "Top-Up".

"Frais de séjours and chambre particulière"

Hospitalization / Hospitalisation:

The question of payment will come after your wellbeing

If you are in an emergency situation, you will be taken care of regardless of your nationality, professional or financial situation.

However, after this point or if you have a planned hospital stay you could be asked for a “PEC”.

This "PEC" enables the hospital or Clinique to claim amounts due for your treatments directly from your "Régime Obligatoire" and eventually your "TOP-UP".

If you are in France on holiday you may present your “EHIC”.

You will be asked for your blood group card - "carte de groupe sanguin'".

They will ask about allergies - "avez-vous des allergies?" or "êtes-vous allergique?".

You will be asked for your medical history - "antécédents médicaux ou chirurgicaux".

You will be asked about any medication you are taking – "Quel est votre traitement actuel / courant/ en cours?"

They will ask about your diet – "Avez-vous un régime spécial?" Without salt – "Sans sel" Without sugar – "Sans sucre" Gluten free – "Sans gluten"

Key Words:

|

Useful Phrases:

|

| ENGLISH |

FRENCH |

| Aching |

Douloureux |

| Ambulance |

Ambulance |

| Anaesthetic |

Anesthésique |

| Anaesthetic |

Anesthésie |

| Ankle |

La cheville |

| Appendix |

L'appendice |

| Arm |

Le bras |

| Assistant nurse |

Aide soignante |

| Back |

Le dos |

| Back of the neck |

La nuque |

| Bedpan |

Un bassin |

| Bell / buzzer |

Sonnette |

| Bladder |

La vessie |

| Blood |

Le sang |

| Blood test |

Prise de sang |

| Blood test (results) |

Résultat sanguin, Bilan sanguin |

| Blood test to be taken fasting |

Prise de sang à jeun |

| Body |

Le corps |

| Bone |

L'os |

| Bottle |

Une bouteille |

| Bowels |

Les intestins |

| Brain |

Le cerveau |

| Breast |

Le sein |

| Bruise |

Un bleu /une contusion / un hématome |

| Burn |

une brûlure |

| Burning sensation |

Sensation de chaleur / douleur cuisante |

| Buttocks / bottom |

Les fesses |

| Calf |

Le mollet |

| Capsule |

Gélule |

| Car accident |

Accident de la route |

| Casualty / A&E |

Urgences |

| Change your dressing |

Faire votre pansement |

| Cheeks |

Les joues |

| Chest |

La poitrine |

| Chin |

Le menton |

| Collarbone |

La clavicule |

| Contraceptive pill |

La pilule |

| Cough / a cough |

Tousser / une toux |

| Covered in bruised |

Etre couvert de bleus |

| Crushed |

Ecrasé / broyé |

| Crutches |

Les béquilles |

| Cut |

coupe |

| Dizziness |

le vertige |

| Doctor |

Médecin |

| Drawsheet |

L’alèse |

| Dressing gown |

Robe de chambre |

| Drink (A) |

Une boisson |

| Drink (To) |

Boire |

| Ear |

L'oreille |

| Eat |

Manger |

| ECG |

Electrocardiogramme (électro) |

| Elbow |

Le coude |

| Exhausted |

épuisé |

| Eye (eyes) |

L’œil (Les yeux) |

| Face |

Le visage |

| Face flannel |

Un gant de toilette |

| Feel sick |

J'ai des nausées / J'ai mal au cœur |

| Feel unwell / faint |

J'ai un malaise / j'ai la tête qui tourne |

| Finger |

Le doigt |

| Fingernail |

L'ongle |

| Foot |

Le pied |

| Forehead |

Le front |

| Gall bladder |

La vésicule biliaire |

| Get undressed |

Déshabillez-vous |

| Grazed |

écorché |

| Gum |

Gencive |

| Hand |

La main |

| Have a wash |

Faire sa toilette |

| Head |

La tête |

| Heart |

Le cœur |

| Heel |

Le talon |

| High temperature |

la fièvre |

| Hip |

La hanche |

| Hospital gown (open at the back) |

Casaque / blouse opératoire |

| Infection |

Infection |

| Injection |

Piqûre |

| Intensive care |

Soins intensive |

| Jaw |

La mâchoire |

| Kidney |

Le rein |

| Knee |

Le genou |

| Liver |

Le foie |

| Lower back |

Les lombaires / les reins |

| Lungs |

Les poumons |

| Make the bed |

Faire le lit |

| Meal |

Un repas |

| Medicine (treatment) |

Médicament / traitement |

| Mouth |

La bouche |

| Muscle |

Le muscle |

| Nausea |

la nausée |

| Neck |

Le cou |

| Nightdress |

Chemise de nuit |

| Nose |

Le nez |

| Nurse |

Infirmière |

| Operating theatre |

Bloc opératoire |

| Operation |

Intervention chirurgicale |

| Operation |

Intervention |

| Out of breath |

essoufflé |

| Pain killer |

Calmant |

| Paramedics |

SAMU |

| Permission to operate |

Autorisation d’opérer |

| Physio after an accident |

Re-éducation |

| Physiotherapist |

Kinésithérapeute |

| Physiotherapy |

Kinésithérapie |

| Pill |

Cachet / Comprime |

| Pyjamas |

Pyjama |

| Rib |

La côte |

| Scratch |

une égratignure |

| Sensitive |

Sensible |

| Set up a drip |

Faire une perfusion |

| Shoulder |

L’épaule |

| Sleeping pill |

Somnifère |

| Slippers |

Pantoufles |

| Soap |

Le savon |

| Sore |

endolori |

| Spleen |

La rate |

| Sticking plaster |

Sparadrap / pansement adhésif |

| Stitches |

Points de suture |

| Stomach (external) |

Le ventre |

| Stomach (internal) |

L'estomac |

| Stretcher |

Brancard |

| Surgeon |

Chirurgien |

| Surgical dressing |

Pansement |

| Swelling |

une bosse |

| Swollen |

enfle |

| Take your blood pressure |

Contrôler votre tension |

| Teeth |

Les dents |

| Tender |

sensible |

| Tendon |

Le tendon |

| Thigh |

La cuisse |

| Throat |

La gorge |

| Thumb |

Le pouce |

| Tired |

fatigue |

| Toenail |

L'ongle du pied |

| Toes |

Les orteils |

| Tongue |

Le langue |

| Towel |

Une serviette |

| Ulcer |

ulcère |

| Water |

L'eau |

| Wheelchair |

Fauteuil roulant |

| Wounded |

blessé |

| Wrist |

Le poignet |

| X-ray |

Radio |

|

| ENGLISH |

FRENCH |

| Call an ambulance |

Appeler une ambulance |

| Call the emergency services |

Appeler le urgences |

| Call the police |

Appeler la police |

| Do not get up |

Ne pas se lever |

| Do you know an English speeking doctor? |

Connaissez-vous un médecin qui parle anglais? |

| Do you want an injection? |

Voulez-vous une piqûre? |

| I am allergic to… |

Je suis allergique a / a la / aux… |

| I am constipated |

Je suis constipé(e) |

| I am diabetic |

J'ai le diabète |

| I am going to faint |

Je vais m’evanouir |

| I am in pain |

J'ai mal |

| I am taking medication |

Je prends des médicament |

| I don't feel very well |

Je ne me sens pas tres bien |

| I feel better |

Je me sens mieux |

| I feel sick |

J'ai envie de vomir / J'ai mal au cœur |

| I feel bad |

Je me sens mal |

| I feel weak |

Je me sent faible |

| I feel worse |

Je me sens moins bien |

| I fell over |

Je suis tomber |

| I have a broken bone |

J’ai une fracture |

| I have a broken tooth |

J'ai une dent cassée |

| I have a chest cold |

J’ai une bronchite |

| I have a cold |

Je suis enrhumé |

| I have a cold |

J’ai une rhume |

| I have a got fever |

J’ai de la fievre |

| I have a headache |

J'ai mal à la tête |

| I have a sore throat / tonsilitis |

J'ai mal a la gorge / j'ai une angine |

| I have a wound |

J’ai une blessure |

| I have an abscess |

J'ai un abcès |

| I have an abscess |

J’ai un abcès |

| I have back ache |

J'ai mal au dos |

| I have been sick |

J'ai vomi |

| I have burnt myself |

Je me suis brûlé |

| I have chest pains |

J’ai des douleur à la poitrine |

| I have cut myself |

Je me suis coupé |

| I have flu |

J'ai la grippe |

| I have gor a head ache |

J’ai mal à la tête |

| I have got a headache |

J’ai mal à la tête |

| I have got a sore throat |

J’ai mal à la gorge |

| I have got a stomach ache |

J’ai mal à l’estomac |

| I have got cramps |

J’ai des cramps |

| I have got diarrhea |

J’ai la diarrhea |

| I have had a heart attack |

J’ai eu une crise cardiaque |

| I have lost a filling |

J'ai perdu un plombage |

| I have pain |

J'ai de la douleur |

| I have pains in the chest |

J'ai mal à la poitrine |

| I have shivers |

J’ai des frissons |

| I have stomach ache |

J'ai mal au ventre |

| I have the flu |

J’ai la grippe |

| I have to see a doctor |

J'ai dois de voir un médecin |

| I have toothache |

J'ai mal aux dents |

| I have wind |

J'ai des gaz |

| I need a bedpan |

J’ai besoin d'un bassin |

| I think it's broken |

Je pense que c'est cassé |

| I want a pee |

Je veux faire pipi |

| I'm bleeding |

Je saigne |

| I'm dizzy |

J’ai la vertige |

| I'm hungry |

J'ai faim |

| I'm sick |

Je suis malade |

| I'm sweating |

Je transpire |

| I'm thirsty |

J'ai soif |

| Is it serious? |

C’est grave? |

| It hurts everywhere |

J’ai mal partôut |

| It hurts here |

J’ai mal ici |

| It is painful since… |

C'est douloureux depuis… |

| Its swelling |

Ca enfle |

| I've been sick |

J'ai vomi |

| I've got the shivers |

J'ai des frissons |

| Permanent filling |

Obturation définitive |

| Stay lying down |

Restez allongé |

| Temporary filling |

Obturation provisoire |

| That hurts |

ça me fait Mal |

| That hurts! |

Ca me fait mal ! |

| That is very painful |

C'est très douloureux |

| That itches |

Ca me démange |

| That itches |

Ca me gratte |

| That tickles |

Ca me chatouille |

| That's too loose |

Ce n'est pas assez serré |

| That's too tight |

C'est trop serré |

| There has been an accident |

Il y a eu un accident |

| To have a bowel movement (phoo) |

Aller à la selle (faire caca) |

| To ring (for a nurse) |

Sonner l'infermiere |

| To urinate |

Uriner (faire pipi) |

| Where is the Chemist? |

Ou se trouve la pharmacie? |

| Where is the Doctors? |

Ou se trouve un medecin? |

| Where is the Hospital? |

Ou se trouve l'hôpital? |

|

Partners

Health cover in France - A few definitions

A FEW DEFINITIONS

Understanding The French System:

Unlike the English system, the French regime makes no difference between the public and private treatments

(the reimbursement rates are identical).

On the other-hand, the 'Sécurité Sociale' alone does not cover the entirety of your expenses.

First column represents the total cost of your medical treatment.

Second column shows the possible reimbursements:

Orange = reimbursable with minimum cover

Orange to Red = Only reimbursable with higher cover or not at all.

Third column indicates where the reimbursements could come from.

Click on each column to see their individual definitions:

Frais Médicaux :

The TOTAL amount charged for your treatment.

This can be a Fixed rate or an amount announced by a specialist.

Dépassement d'honoraires :

Amount charged by a Doctor for time spent treating a patient.

A Doctor in "Secteur 1" will NOT charge over the"Tarif de Convention" and you will be totally reimbursed even on the lowest levels of Top-UP.

A Doctor in "Secteur 2" can charge over the "Tarif de Convention" and you will only be reimbursed if you have a higher level of "Top-Up".

You could be faced with "Dépassement d'honoraires" for a simple 15 minute specialist visit or for 4 hours of Major Surgery.

Rates charged must be communicated in advance, get in contact with the administration if not. .

Tarif de Convention :

Base rate given to medical treatment recognizable by a code that indicates its nature and tariff called “Nomenclature” fixed by the “CCAM”(Classification Commune des Actes Médicaux).

The “Tarif de Convention” fixes the 100% base rate that all medical professionals use but it does NOT limit their fees charged.

Top-Ups relate to the base rate and NOT to actual expenses. .

Ticket modérateur :

This represents the difference between your “Régime Obligatoire” reimbursements and the "Tarif de Convention".

This amount, normally reimbursed by a Top-Up will be reimbursed by your “Régime Obligatoire” in case of long-term illness, handicap or maternity.

The “100%” or the "TM" referred to on "Tiers Payant“ slips from Top-Ups will guarantee payment of the "Ticket Moderateur" to any professional accepting to use this facility without having to advance any money. .

Part Régime Obligaroire :

The Percentage of the "Tarif de Convention" that is covered by your “Régime Obligatoire”.

Usually these reimbursements come from "CPAM" or “RSI” if you are self employed.

Reimbursements range from 35% to 100% but are commonly referred to as 70% of the "Tarif de Convention".

Once fully into the French system you will receive a “Carte Vitale”.

This card replaces payment to medical professionals equipped with the “System Noemi”.

Part Régime Complémentaire :

"Part Mutuelle". This is the amount paid on your behalf by a Top-Up.

"Dépassement d'honoraires" can be reimbursed by a Top-Up.

Top-Ups starts at 100% and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICA’s sugests middle cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for the rest as some base rates are very low.

Hors Nomenclature:

These are treatments that are NOT included on the “CCAM” list thus they do not have a base rate.

These treatments are often in addition to ongoing treatment.

The “CCAM” tend to exclude preventative medicines, "Médecines douces“ that have not been accepted by the “Académie des Sciences”.

Some Top-Ups reimburse thing like osteopathy and homeopathy using Fixed rates set by the companies called “Forfait Annuel”.

Examples of reimbursement:

SOFICAS clients benifit fully from the French system  as we use French companies that know thier subject.

as we use French companies that know thier subject.

"Télétransmition"

Automatic reimbursements using only your "Carte Vitale".

"Tiers Payant"

No money to be advanced at the chemist / lab / x-ray and more.

"Prise en charge"

Possible on demand even for Optical and Dentistry.

Hospitals stay expenses can be paid directly by your "Top-Up".

"Frais de séjours and chambre particulière"

Hospitalization / Hospitalisation:

The question of payment will come after your wellbeing

If you are in an emergency situation, you will be taken care of regardless of your nationality, professional or financial situation.

However, after this point or if you have a planned hospital stay you could be asked for a “PEC”.

This "PEC" enables the hospital or Clinique to claim amounts due for your treatments directly from your "Régime Obligatoire" and eventually your "TOP-UP".

If you are in France on holiday you may present your “EHIC”.

You will be asked for your blood group card - "carte de groupe sanguin'".

They will ask about allergies - "avez-vous des allergies?" or "êtes-vous allergique?".

You will be asked for your medical history - "antécédents médicaux ou chirurgicaux".

You will be asked about any medication you are taking – "Quel est votre traitement actuel / courant/ en cours?"

They will ask about your diet – "Avez-vous un régime spécial?" Without salt – "Sans sel" Without sugar – "Sans sucre" Gluten free – "Sans gluten"

Key Words:

|

Useful Phrases:

|

| ENGLISH |

FRENCH |

| Aching |

Douloureux |

| Ambulance |

Ambulance |

| Anaesthetic |

Anesthésique |

| Anaesthetic |

Anesthésie |

| Ankle |

La cheville |

| Appendix |

L'appendice |

| Arm |

Le bras |

| Assistant nurse |

Aide soignante |

| Back |

Le dos |

| Back of the neck |

La nuque |

| Bedpan |

Un bassin |

| Bell / buzzer |

Sonnette |

| Bladder |

La vessie |

| Blood |

Le sang |

| Blood test |

Prise de sang |

| Blood test (results) |

Résultat sanguin, Bilan sanguin |

| Blood test to be taken fasting |

Prise de sang à jeun |

| Body |

Le corps |

| Bone |

L'os |

| Bottle |

Une bouteille |

| Bowels |

Les intestins |

| Brain |

Le cerveau |

| Breast |

Le sein |

| Bruise |

Un bleu /une contusion / un hématome |

| Burn |

une brûlure |

| Burning sensation |

Sensation de chaleur / douleur cuisante |

| Buttocks / bottom |

Les fesses |

| Calf |

Le mollet |

| Capsule |

Gélule |

| Car accident |

Accident de la route |

| Casualty / A&E |

Urgences |

| Change your dressing |

Faire votre pansement |

| Cheeks |

Les joues |

| Chest |

La poitrine |

| Chin |

Le menton |

| Collarbone |

La clavicule |

| Contraceptive pill |

La pilule |

| Cough / a cough |

Tousser / une toux |

| Covered in bruised |

Etre couvert de bleus |

| Crushed |

Ecrasé / broyé |

| Crutches |

Les béquilles |

| Cut |

coupe |

| Dizziness |

le vertige |

| Doctor |

Médecin |

| Drawsheet |

L’alèse |

| Dressing gown |

Robe de chambre |

| Drink (A) |

Une boisson |

| Drink (To) |

Boire |

| Ear |

L'oreille |

| Eat |

Manger |

| ECG |

Electrocardiogramme (électro) |

| Elbow |

Le coude |

| Exhausted |

épuisé |

| Eye (eyes) |

L’œil (Les yeux) |

| Face |

Le visage |

| Face flannel |

Un gant de toilette |

| Feel sick |

J'ai des nausées / J'ai mal au cœur |

| Feel unwell / faint |

J'ai un malaise / j'ai la tête qui tourne |

| Finger |

Le doigt |

| Fingernail |

L'ongle |

| Foot |

Le pied |

| Forehead |

Le front |

| Gall bladder |

La vésicule biliaire |

| Get undressed |

Déshabillez-vous |

| Grazed |

écorché |

| Gum |

Gencive |

| Hand |

La main |

| Have a wash |

Faire sa toilette |

| Head |

La tête |

| Heart |

Le cœur |

| Heel |

Le talon |

| High temperature |

la fièvre |

| Hip |

La hanche |

| Hospital gown (open at the back) |

Casaque / blouse opératoire |

| Infection |

Infection |

| Injection |

Piqûre |

| Intensive care |

Soins intensive |

| Jaw |

La mâchoire |

| Kidney |

Le rein |

| Knee |

Le genou |

| Liver |

Le foie |

| Lower back |

Les lombaires / les reins |

| Lungs |

Les poumons |

| Make the bed |

Faire le lit |

| Meal |

Un repas |

| Medicine (treatment) |

Médicament / traitement |

| Mouth |

La bouche |

| Muscle |

Le muscle |

| Nausea |

la nausée |

| Neck |

Le cou |

| Nightdress |

Chemise de nuit |

| Nose |

Le nez |

| Nurse |

Infirmière |

| Operating theatre |

Bloc opératoire |

| Operation |

Intervention chirurgicale |

| Operation |

Intervention |

| Out of breath |

essoufflé |

| Pain killer |

Calmant |

| Paramedics |

SAMU |

| Permission to operate |

Autorisation d’opérer |

| Physio after an accident |

Re-éducation |

| Physiotherapist |

Kinésithérapeute |

| Physiotherapy |

Kinésithérapie |

| Pill |

Cachet / Comprime |

| Pyjamas |

Pyjama |

| Rib |

La côte |

| Scratch |

une égratignure |

| Sensitive |

Sensible |

| Set up a drip |

Faire une perfusion |

| Shoulder |

L’épaule |

| Sleeping pill |

Somnifère |

| Slippers |

Pantoufles |

| Soap |

Le savon |

| Sore |

endolori |

| Spleen |

La rate |

| Sticking plaster |

Sparadrap / pansement adhésif |

| Stitches |

Points de suture |

| Stomach (external) |

Le ventre |

| Stomach (internal) |

L'estomac |

| Stretcher |

Brancard |

| Surgeon |

Chirurgien |

| Surgical dressing |

Pansement |

| Swelling |

une bosse |

| Swollen |

enfle |

| Take your blood pressure |

Contrôler votre tension |

| Teeth |

Les dents |

| Tender |

sensible |

| Tendon |

Le tendon |

| Thigh |

La cuisse |

| Throat |

La gorge |

| Thumb |

Le pouce |

| Tired |

fatigue |

| Toenail |

L'ongle du pied |

| Toes |

Les orteils |

| Tongue |

Le langue |

| Towel |

Une serviette |

| Ulcer |

ulcère |

| Water |

L'eau |

| Wheelchair |

Fauteuil roulant |

| Wounded |

blessé |

| Wrist |

Le poignet |

| X-ray |

Radio |

|

| ENGLISH |

FRENCH |

| Call an ambulance |

Appeler une ambulance |

| Call the emergency services |

Appeler le urgences |

| Call the police |

Appeler la police |

| Do not get up |

Ne pas se lever |

| Do you know an English speeking doctor? |

Connaissez-vous un médecin qui parle anglais? |

| Do you want an injection? |

Voulez-vous une piqûre? |

| I am allergic to… |

Je suis allergique a / a la / aux… |

| I am constipated |

Je suis constipé(e) |

| I am diabetic |

J'ai le diabète |

| I am going to faint |

Je vais m’evanouir |

| I am in pain |

J'ai mal |

| I am taking medication |

Je prends des médicament |

| I don't feel very well |

Je ne me sens pas tres bien |

| I feel better |

Je me sens mieux |

| I feel sick |

J'ai envie de vomir / J'ai mal au cœur |

| I feel bad |

Je me sens mal |

| I feel weak |

Je me sent faible |

| I feel worse |

Je me sens moins bien |

| I fell over |

Je suis tomber |

| I have a broken bone |

J’ai une fracture |

| I have a broken tooth |

J'ai une dent cassée |

| I have a chest cold |

J’ai une bronchite |

| I have a cold |

Je suis enrhumé |

| I have a cold |

J’ai une rhume |

| I have a got fever |

J’ai de la fievre |

| I have a headache |

J'ai mal à la tête |

| I have a sore throat / tonsilitis |

J'ai mal a la gorge / j'ai une angine |

| I have a wound |

J’ai une blessure |

| I have an abscess |

J'ai un abcès |

| I have an abscess |

J’ai un abcès |

| I have back ache |

J'ai mal au dos |

| I have been sick |

J'ai vomi |

| I have burnt myself |

Je me suis brûlé |

| I have chest pains |

J’ai des douleur à la poitrine |

| I have cut myself |

Je me suis coupé |

| I have flu |

J'ai la grippe |

| I have gor a head ache |

J’ai mal à la tête |

| I have got a headache |

J’ai mal à la tête |

| I have got a sore throat |

J’ai mal à la gorge |

| I have got a stomach ache |

J’ai mal à l’estomac |

| I have got cramps |

J’ai des cramps |

| I have got diarrhea |

J’ai la diarrhea |

| I have had a heart attack |

J’ai eu une crise cardiaque |

| I have lost a filling |

J'ai perdu un plombage |

| I have pain |

J'ai de la douleur |

| I have pains in the chest |

J'ai mal à la poitrine |

| I have shivers |

J’ai des frissons |

| I have stomach ache |

J'ai mal au ventre |

| I have the flu |

J’ai la grippe |

| I have to see a doctor |

J'ai dois de voir un médecin |

| I have toothache |

J'ai mal aux dents |

| I have wind |

J'ai des gaz |

| I need a bedpan |

J’ai besoin d'un bassin |

| I think it's broken |

Je pense que c'est cassé |

| I want a pee |

Je veux faire pipi |

| I'm bleeding |

Je saigne |

| I'm dizzy |

J’ai la vertige |

| I'm hungry |

J'ai faim |

| I'm sick |

Je suis malade |

| I'm sweating |

Je transpire |

| I'm thirsty |

J'ai soif |

| Is it serious? |

C’est grave? |

| It hurts everywhere |

J’ai mal partôut |

| It hurts here |

J’ai mal ici |

| It is painful since… |

C'est douloureux depuis… |

| Its swelling |

Ca enfle |

| I've been sick |

J'ai vomi |

| I've got the shivers |

J'ai des frissons |

| Permanent filling |

Obturation définitive |

| Stay lying down |

Restez allongé |

| Temporary filling |

Obturation provisoire |

| That hurts |

ça me fait Mal |

| That hurts! |

Ca me fait mal ! |

| That is very painful |

C'est très douloureux |

| That itches |

Ca me démange |

| That itches |

Ca me gratte |

| That tickles |

Ca me chatouille |

| That's too loose |

Ce n'est pas assez serré |

| That's too tight |

C'est trop serré |

| There has been an accident |

Il y a eu un accident |

| To have a bowel movement (phoo) |

Aller à la selle (faire caca) |

| To ring (for a nurse) |

Sonner l'infermiere |

| To urinate |

Uriner (faire pipi) |

| Where is the Chemist? |

Ou se trouve la pharmacie? |

| Where is the Doctors? |

Ou se trouve un medecin? |

| Where is the Hospital? |

Ou se trouve l'hôpital? |

|

Partners

FINANCIAL ADVICE

|  Background Background

Along with the resources of The Spectrum IFA Group, one of Europe’s leading independent intermediaries, Brian Furzer brings more than 30 years experience to the financial services industry. He specialises in addressing the unique financial planning needs of expatriates and those with cross-border interests and has a detailed knowledge of international product providers and tax-efficient structures that can assist in asset building, asset protection and, ultimately, estate planning.

As an independent adviser, Brian provides clients with the advantage of unbiased financial planning advice. He has access to many of the world’s most respected international banking, investment management and insurance institutions, which brings his clients the competitive advantages and convenience of being able to access multiple managers and product providers through one source.

Fees

Brian does not charge consulting fees for providing you with advice or on-going service. The Spectrum IFA Group receives industry-standard fees directly from the financial institutions with which they place their clients’ investments - not directly from clients.

Clients

Clients have varied needs, but typically either have disposable income they wish to invest regularly towards their medium to long-term goals, or have accrued capital they would like to invest for growth or to provide an income. Clients are introduced to Brian either by personal introduction (referral by existing clients), or by means of professional introduction (by financial institutions, employer Human Resources departments or by professional service providers such as accountants, lawyers, trust managers or relocation specialists).

Brian works with clients of all ages, wealth and financial experience. It is a well-established principle that people who plan for their goals are far more likely to reach them than those who don’t!

Other Information

He is a French resident and lives in the unspoilt countryside of the Charente Maritime bordering on Aquitaine between Bordeaux and La Rochelle.Keen on outdoor pursuits and nature generally, Brian is an accomplished flyfisher for trout and salmon and has qualified for the English Flyfishing Team and has published four books internationally on flyfishing. The Charente Maritime is the perfect environment for pursuing his interest of observing nature, particularly the varied birdlife of the area.

Brian is a member of the Franco British Chamber of Commerce & Industry.

Brian provides an initial confidential consultation to:

• Assist you in evaluating existing pensions, protection (insurance) and savings / investment provision in a comprehensible manner.

• Identify and prioritise your financial objectives (short, medium and long-term).

• Identify how to reach those objectives, on the basis of resources you can comfortably engage. Importantly, he will focus on present and future tax-efficiency, product portability, your attitude to risk and events that may threaten the financial wellbeing of you and your dependents.

Next he will prepare a report recommending solutions matching your requirements and include any relevant product literature and illustrations to enable you to make an informed decision. Crucially, Spectrum are not agents for any particular company- representing clients from an unbiased position of independence. We feel that this strongly sets us apart from dealing directly with large institutions, where you may experience less-personal service, a high turnover of staff familiar with your circumstances and where there may be a bias to recommend their own products and services.

Spectrum’s recommendations are made without obligation or charge. You are free to accept our advice wholly, partly or not at all. We are pleased also to negotiate and arrange access to holdings specifically of your choice.

|

Why use Currencies Direct? - the benefits.

Challenging traditional banking conventions, Currencies Direct guarantees to beat any retail bank both in price and service. From the moment we were established our aim has been simple. To provide a personalised service and save our clients money from dealing with traditional banks.

- Increasing your spending power. Because we deal directly with the currency markets we can offer the best foreign money exchange rates that the banks find hard to beat. These great foreign currency exchange rates mean that you get more for your money.

- Saving you money. We want to make sure that you get the best forex deals you can so that's why we offer all our clients free transfers (over £5,000) and charge no commission. Plus, Currencies Direct does not charge lifting/receiving fees on forex transfers.

- Tailored to your circumstances. As specialist foreign exchange brokers we are able to offer a number of product choices for foreign exchange including spot deals, forward contracts and limit orders. Which one is right for you will depend on your circumstances, foreign currency needs and timing.

- Easy to deal with. You can trade in forex with us by phone, talking directly to a currency specialist, electronically or by fax. The first step is to become a registered private or business customer. Our registration process is second to none. You can register with us online and be ready to trade in minutes.

- Make regular payments overseas. Mortgage, maintenance, insurance - whatever your reason for making regular money transfers Currencies Direct's Overseas Regular Money Transfer Plan can save you money. With free forex transfers, great foreign exchange rates and low minimum amounts we really make is easy to keep benefiting from our great service. Click here for more information.

- For businesses, we are committed to delivering excellence in customer service and solutions to help your business grow and compete more effectively within the global market place.

Currencies Direct Limited is a leading payment technology solutions company and it was one of Europe's first independent foreign exchange specialists in 1996 to recognise the need in the market for an expert secondary Foreign Exchange provider to traditional banks. Its innovative approach is based on dealing directly with the currency markets and matching buyers with sellers thus eliminating intermediaries and giving it a competitive edge in pricing foreign exchange. Twelve years on Currencies Direct is now one of Europe's largest foreign exchange specialist with a head office and operations across 5 continents, with 2,000 strong franchise network of business partners and is part of the Azibo Group.

Trust a specialist to Get it Right on Overseas Transfers

Many of us send money abroad for various reasons. Anything from emigrating; purchasing a holiday home; paying a mortgage or covering monthly business costs, we do this through the obvious vehicle - our bank. The disappointing factor with this choice is we lose money every time we do this, either through bank charges such as transfer fees or through poor foreign exchange rates. Naturally we all trust our bank to handle financial matters, but we don’t consider other options for transferring funds abroad, most probably because we aren’t aware of the benefits of using a specialist foreign exchange provider.

For those who are aware of the charges from the bank and negotiate a better deal; need to consider that banks are often prepared to waive their fee or charges because they can make a substantial profit on offering a poor foreign exchange rate. So however you look at it the banks make money and you lose money on international transfers, the larger the transfer, the more you have to lose.

Every year at Currencies Direct we see new clients joining us; it never ceases to astonish us how much money our clients lose through banks and how much they saved through our services especially on large transfers* or small regular overseas payments. We charge no fees for transfers over £5000 and regular transfers are also fee-free.

You will wonder how businesses like our own make money if you are saving so much? This is simple, we buy £2bn worth of foreign exchange each year so we are able to purchase our currency at wholesale rates. We pass on most of these savings to you, retaining a small margin for ourselves. We guarantee to always beat the banks on exchange rates.

Transferring your funds overseas is very straightforward with Currencies Direct. We process 220 000 payments a year so we have the expertise to make payments swiftly and painlessly. As soon as we receive your funds, we send out the payment immediately to the bank account details you have provided. We send payments to bank accounts in 50 countries and trade in 45 different currencies giving you a wide choice of where you can make transfers.

Working as a specialist broker gives us the advantage of finding the best rates for you and offering you a more personal service, we have numerous solutions that can be tailored to meet your needs. Once you have registered for our service you will receive a personal dealer who will handle your foreign exchange payments, their job is to ensure you receive the best rates as well as giving you the option of buying the rate now or when it meets a target set by you and the dealer. The dealer will discuss with you the best option for your needs. You can make international transfers by speaking to your dealer and agreeing a contract or you can use our online system iPayFX.

Currencies Direct offer a wide range of services to assist you with your international payments. The bottom line is – your best interests are our focus.

Written by Karl Sieha, Currencies Direct

*Currencies Direct can typically save clients up to three per cent of the overall amount of money being transferred compared to mainstream banks. And, unlike most other exchanges, it does not charge a commission and waives its transaction fee on deals above £5,000.

Partners

Health cover in France - A few definitions

A FEW DEFINITIONS

Understanding The French System:

Unlike the English system, the French regime makes no difference between the public and private treatments

(the reimbursement rates are identical).

On the other-hand, the 'Sécurité Sociale' alone does not cover the entirety of your expenses.

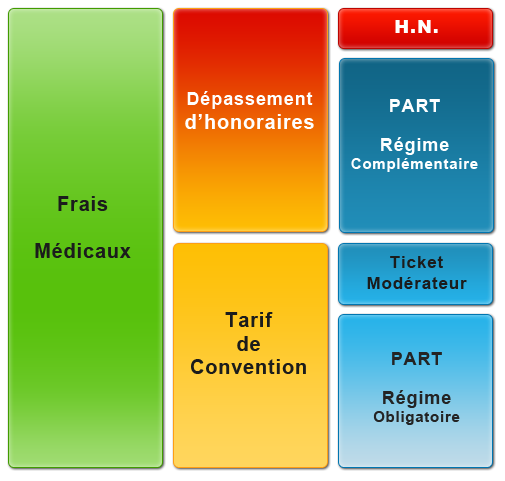

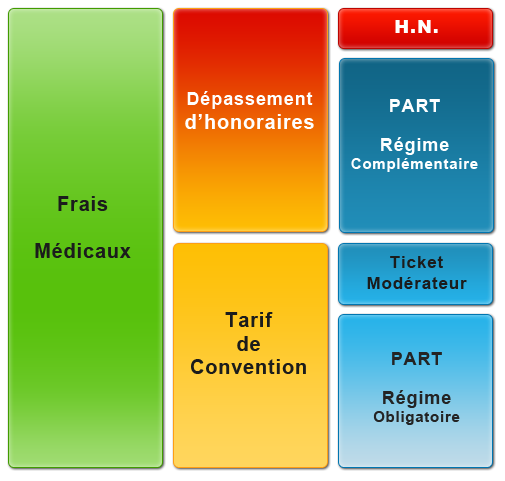

First column represents the total cost of your medical treatment.

Second column shows the possible reimbursements:

Orange = reimbursable with minimum cover

Orange to Red = Only reimbursable with higher cover or not at all.

Third column indicates where the reimbursements could come from.

Click on each column to see their individual definitions:

Frais Médicaux :

The TOTAL amount charged for your treatment.

This can be a Fixed rate or an amount announced by a specialist.

Dépassement d'honoraires :

Amount charged by a Doctor for time spent treating a patient.

A Doctor in "Secteur 1" will NOT charge over the"Tarif de Convention" and you will be totally reimbursed even on the lowest levels of Top-UP.

A Doctor in "Secteur 2" can charge over the "Tarif de Convention" and you will only be reimbursed if you have a higher level of "Top-Up".

You could be faced with "Dépassement d'honoraires" for a simple 15 minute specialist visit or for 4 hours of Major Surgery.

Rates charged must be communicated in advance, get in contact with the administration if not. .

Tarif de Convention :

Base rate given to medical treatment recognizable by a code that indicates its nature and tariff called “Nomenclature” fixed by the “CCAM”(Classification Commune des Actes Médicaux).

The “Tarif de Convention” fixes the 100% base rate that all medical professionals use but it does NOT limit their fees charged.

Top-Ups relate to the base rate and NOT to actual expenses. .

Ticket modérateur :

This represents the difference between your “Régime Obligatoire” reimbursements and the "Tarif de Convention".

This amount, normally reimbursed by a Top-Up will be reimbursed by your “Régime Obligatoire” in case of long-term illness, handicap or maternity.

The “100%” or the "TM" referred to on "Tiers Payant“ slips from Top-Ups will guarantee payment of the "Ticket Moderateur" to any professional accepting to use this facility without having to advance any money. .

Part Régime Obligaroire :

The Percentage of the "Tarif de Convention" that is covered by your “Régime Obligatoire”.

Usually these reimbursements come from "CPAM" or “RSI” if you are self employed.

Reimbursements range from 35% to 100% but are commonly referred to as 70% of the "Tarif de Convention".

Once fully into the French system you will receive a “Carte Vitale”.

This card replaces payment to medical professionals equipped with the “System Noemi”.

Part Régime Complémentaire :

"Part Mutuelle". This is the amount paid on your behalf by a Top-Up.

"Dépassement d'honoraires" can be reimbursed by a Top-Up.

Top-Ups starts at 100% and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICA’s sugests middle cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for the rest as some base rates are very low.

Hors Nomenclature:

These are treatments that are NOT included on the “CCAM” list thus they do not have a base rate.

These treatments are often in addition to ongoing treatment.

The “CCAM” tend to exclude preventative medicines, "Médecines douces“ that have not been accepted by the “Académie des Sciences”.

Some Top-Ups reimburse thing like osteopathy and homeopathy using Fixed rates set by the companies called “Forfait Annuel”.

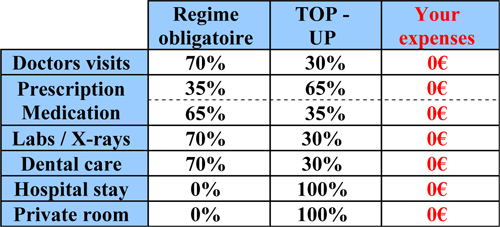

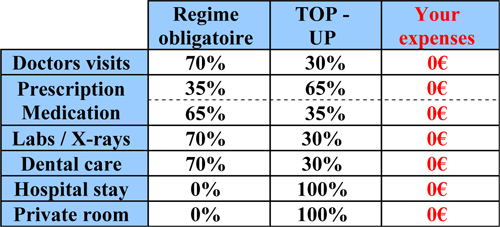

Examples of reimbursement:

SOFICAS clients benifit fully from the French system  as we use French companies that know thier subject.

as we use French companies that know thier subject.

"Télétransmition"

Automatic reimbursements using only your "Carte Vitale".

"Tiers Payant"

No money to be advanced at the chemist / lab / x-ray and more.

"Prise en charge"

Possible on demand even for Optical and Dentistry.

Hospitals stay expenses can be paid directly by your "Top-Up".

"Frais de séjours and chambre particulière"

Hospitalization / Hospitalisation:

The question of payment will come after your wellbeing

If you are in an emergency situation, you will be taken care of regardless of your nationality, professional or financial situation.

However, after this point or if you have a planned hospital stay you could be asked for a “PEC”.

This "PEC" enables the hospital or Clinique to claim amounts due for your treatments directly from your "Régime Obligatoire" and eventually your "TOP-UP".

If you are in France on holiday you may present your “EHIC”.

You will be asked for your blood group card - "carte de groupe sanguin'".

They will ask about allergies - "avez-vous des allergies?" or "êtes-vous allergique?".

You will be asked for your medical history - "antécédents médicaux ou chirurgicaux".

You will be asked about any medication you are taking – "Quel est votre traitement actuel / courant/ en cours?"

They will ask about your diet – "Avez-vous un régime spécial?" Without salt – "Sans sel" Without sugar – "Sans sucre" Gluten free – "Sans gluten"

Key Words:

|

Useful Phrases:

|

| ENGLISH |

FRENCH |

| Aching |

Douloureux |

| Ambulance |

Ambulance |

| Anaesthetic |

Anesthésique |

| Anaesthetic |

Anesthésie |

| Ankle |

La cheville |

| Appendix |

L'appendice |

| Arm |

Le bras |

| Assistant nurse |

Aide soignante |

| Back |

Le dos |

| Back of the neck |

La nuque |

| Bedpan |

Un bassin |

| Bell / buzzer |

Sonnette |

| Bladder |

La vessie |

| Blood |

Le sang |

| Blood test |

Prise de sang |

| Blood test (results) |

Résultat sanguin, Bilan sanguin |

| Blood test to be taken fasting |

Prise de sang à jeun |

| Body |

Le corps |

| Bone |

L'os |

| Bottle |

Une bouteille |

| Bowels |

Les intestins |

| Brain |

Le cerveau |

| Breast |

Le sein |

| Bruise |

Un bleu /une contusion / un hématome |

| Burn |

une brûlure |

| Burning sensation |

Sensation de chaleur / douleur cuisante |

| Buttocks / bottom |

Les fesses |

| Calf |

Le mollet |

| Capsule |

Gélule |

| Car accident |

Accident de la route |

| Casualty / A&E |

Urgences |

| Change your dressing |

Faire votre pansement |

| Cheeks |

Les joues |

| Chest |

La poitrine |

| Chin |

Le menton |

| Collarbone |

La clavicule |

| Contraceptive pill |

La pilule |

| Cough / a cough |

Tousser / une toux |

| Covered in bruised |

Etre couvert de bleus |

| Crushed |

Ecrasé / broyé |

| Crutches |

Les béquilles |

| Cut |

coupe |

| Dizziness |

le vertige |

| Doctor |

Médecin |

| Drawsheet |

L’alèse |

| Dressing gown |

Robe de chambre |

| Drink (A) |

Une boisson |

| Drink (To) |

Boire |

| Ear |

L'oreille |

| Eat |

Manger |

| ECG |

Electrocardiogramme (électro) |

| Elbow |

Le coude |

| Exhausted |

épuisé |

| Eye (eyes) |

L’œil (Les yeux) |

| Face |

Le visage |

| Face flannel |

Un gant de toilette |

| Feel sick |

J'ai des nausées / J'ai mal au cœur |

| Feel unwell / faint |

J'ai un malaise / j'ai la tête qui tourne |

| Finger |

Le doigt |

| Fingernail |

L'ongle |

| Foot |

Le pied |

| Forehead |

Le front |

| Gall bladder |

La vésicule biliaire |

| Get undressed |

Déshabillez-vous |

| Grazed |

écorché |

| Gum |

Gencive |

| Hand |

La main |

| Have a wash |

Faire sa toilette |

| Head |

La tête |

| Heart |

Le cœur |

| Heel |

Le talon |

| High temperature |

la fièvre |

| Hip |

La hanche |

| Hospital gown (open at the back) |

Casaque / blouse opératoire |

| Infection |

Infection |

| Injection |

Piqûre |

| Intensive care |

Soins intensive |

| Jaw |

La mâchoire |

| Kidney |

Le rein |

| Knee |

Le genou |

| Liver |

Le foie |

| Lower back |

Les lombaires / les reins |

| Lungs |

Les poumons |

| Make the bed |

Faire le lit |

| Meal |

Un repas |

| Medicine (treatment) |

Médicament / traitement |

| Mouth |

La bouche |

| Muscle |

Le muscle |

| Nausea |

la nausée |

| Neck |

Le cou |

| Nightdress |

Chemise de nuit |

| Nose |

Le nez |

| Nurse |

Infirmière |

| Operating theatre |

Bloc opératoire |

| Operation |

Intervention chirurgicale |

| Operation |

Intervention |

| Out of breath |

essoufflé |

| Pain killer |

Calmant |

| Paramedics |

SAMU |

| Permission to operate |

Autorisation d’opérer |

| Physio after an accident |

Re-éducation |

| Physiotherapist |

Kinésithérapeute |

| Physiotherapy |

Kinésithérapie |

| Pill |

Cachet / Comprime |

| Pyjamas |

Pyjama |

| Rib |

La côte |

| Scratch |

une égratignure |

| Sensitive |

Sensible |

| Set up a drip |

Faire une perfusion |

| Shoulder |

L’épaule |

| Sleeping pill |

Somnifère |

| Slippers |

Pantoufles |

| Soap |

Le savon |

| Sore |

endolori |

| Spleen |

La rate |

| Sticking plaster |

Sparadrap / pansement adhésif |

| Stitches |

Points de suture |

| Stomach (external) |

Le ventre |

| Stomach (internal) |

L'estomac |

| Stretcher |

Brancard |

| Surgeon |

Chirurgien |

| Surgical dressing |

Pansement |

| Swelling |

une bosse |

| Swollen |

enfle |

| Take your blood pressure |

Contrôler votre tension |

| Teeth |

Les dents |

| Tender |

sensible |

| Tendon |

Le tendon |

| Thigh |

La cuisse |

| Throat |

La gorge |

| Thumb |

Le pouce |

| Tired |

fatigue |

| Toenail |

L'ongle du pied |

| Toes |

Les orteils |

| Tongue |

Le langue |

| Towel |

Une serviette |

| Ulcer |

ulcère |

| Water |

L'eau |

| Wheelchair |

Fauteuil roulant |

| Wounded |

blessé |

| Wrist |

Le poignet |

| X-ray |

Radio |

|

| ENGLISH |

FRENCH |

| Call an ambulance |

Appeler une ambulance |

| Call the emergency services |

Appeler le urgences |

| Call the police |

Appeler la police |

| Do not get up |

Ne pas se lever |

| Do you know an English speeking doctor? |

Connaissez-vous un médecin qui parle anglais? |

| Do you want an injection? |

Voulez-vous une piqûre? |

| I am allergic to… |

Je suis allergique a / a la / aux… |

| I am constipated |

Je suis constipé(e) |

| I am diabetic |

J'ai le diabète |

| I am going to faint |

Je vais m’evanouir |

| I am in pain |

J'ai mal |

| I am taking medication |

Je prends des médicament |

| I don't feel very well |

Je ne me sens pas tres bien |

| I feel better |

Je me sens mieux |

| I feel sick |

J'ai envie de vomir / J'ai mal au cœur |

| I feel bad |

Je me sens mal |

| I feel weak |

Je me sent faible |

| I feel worse |

Je me sens moins bien |

| I fell over |

Je suis tomber |

| I have a broken bone |

J’ai une fracture |

| I have a broken tooth |

J'ai une dent cassée |

| I have a chest cold |

J’ai une bronchite |

| I have a cold |

Je suis enrhumé |

| I have a cold |

J’ai une rhume |

| I have a got fever |

J’ai de la fievre |

| I have a headache |

J'ai mal à la tête |

| I have a sore throat / tonsilitis |

J'ai mal a la gorge / j'ai une angine |

| I have a wound |

J’ai une blessure |

| I have an abscess |

J'ai un abcès |

| I have an abscess |

J’ai un abcès |

| I have back ache |

J'ai mal au dos |

| I have been sick |

J'ai vomi |

| I have burnt myself |

Je me suis brûlé |

| I have chest pains |

J’ai des douleur à la poitrine |

| I have cut myself |

Je me suis coupé |

| I have flu |

J'ai la grippe |

| I have gor a head ache |

J’ai mal à la tête |

| I have got a headache |

J’ai mal à la tête |

| I have got a sore throat |

J’ai mal à la gorge |

| I have got a stomach ache |

J’ai mal à l’estomac |

| I have got cramps |

J’ai des cramps |

| I have got diarrhea |

J’ai la diarrhea |

| I have had a heart attack |

J’ai eu une crise cardiaque |

| I have lost a filling |

J'ai perdu un plombage |

| I have pain |

J'ai de la douleur |

| I have pains in the chest |

J'ai mal à la poitrine |

| I have shivers |

J’ai des frissons |

| I have stomach ache |

J'ai mal au ventre |

| I have the flu |

J’ai la grippe |

| I have to see a doctor |

J'ai dois de voir un médecin |

| I have toothache |

J'ai mal aux dents |

| I have wind |

J'ai des gaz |

| I need a bedpan |

J’ai besoin d'un bassin |

| I think it's broken |

Je pense que c'est cassé |

| I want a pee |

Je veux faire pipi |

| I'm bleeding |

Je saigne |

| I'm dizzy |

J’ai la vertige |

| I'm hungry |

J'ai faim |

| I'm sick |

Je suis malade |

| I'm sweating |

Je transpire |

| I'm thirsty |

J'ai soif |

| Is it serious? |

C’est grave? |

| It hurts everywhere |

J’ai mal partôut |

| It hurts here |

J’ai mal ici |

| It is painful since… |

C'est douloureux depuis… |

| Its swelling |

Ca enfle |

| I've been sick |

J'ai vomi |

| I've got the shivers |

J'ai des frissons |

| Permanent filling |

Obturation définitive |

| Stay lying down |

Restez allongé |

| Temporary filling |

Obturation provisoire |

| That hurts |

ça me fait Mal |

| That hurts! |

Ca me fait mal ! |

| That is very painful |

C'est très douloureux |

| That itches |

Ca me démange |

| That itches |

Ca me gratte |

| That tickles |

Ca me chatouille |

| That's too loose |

Ce n'est pas assez serré |

| That's too tight |

C'est trop serré |

| There has been an accident |

Il y a eu un accident |

| To have a bowel movement (phoo) |

Aller à la selle (faire caca) |

| To ring (for a nurse) |

Sonner l'infermiere |

| To urinate |

Uriner (faire pipi) |

| Where is the Chemist? |

Ou se trouve la pharmacie? |

| Where is the Doctors? |

Ou se trouve un medecin? |

| Where is the Hospital? |

Ou se trouve l'hôpital? |

|

Partners

FINANCIAL ADVICE

|  Background Background

Along with the resources of The Spectrum IFA Group, one of Europe’s leading independent intermediaries, Brian Furzer brings more than 30 years experience to the financial services industry. He specialises in addressing the unique financial planning needs of expatriates and those with cross-border interests and has a detailed knowledge of international product providers and tax-efficient structures that can assist in asset building, asset protection and, ultimately, estate planning.

As an independent adviser, Brian provides clients with the advantage of unbiased financial planning advice. He has access to many of the world’s most respected international banking, investment management and insurance institutions, which brings his clients the competitive advantages and convenience of being able to access multiple managers and product providers through one source.

Fees

Brian does not charge consulting fees for providing you with advice or on-going service. The Spectrum IFA Group receives industry-standard fees directly from the financial institutions with which they place their clients’ investments - not directly from clients.

Clients

Clients have varied needs, but typically either have disposable income they wish to invest regularly towards their medium to long-term goals, or have accrued capital they would like to invest for growth or to provide an income. Clients are introduced to Brian either by personal introduction (referral by existing clients), or by means of professional introduction (by financial institutions, employer Human Resources departments or by professional service providers such as accountants, lawyers, trust managers or relocation specialists).

Brian works with clients of all ages, wealth and financial experience. It is a well-established principle that people who plan for their goals are far more likely to reach them than those who don’t!

Other Information

He is a French resident and lives in the unspoilt countryside of the Charente Maritime bordering on Aquitaine between Bordeaux and La Rochelle.Keen on outdoor pursuits and nature generally, Brian is an accomplished flyfisher for trout and salmon and has qualified for the English Flyfishing Team and has published four books internationally on flyfishing. The Charente Maritime is the perfect environment for pursuing his interest of observing nature, particularly the varied birdlife of the area.

Brian is a member of the Franco British Chamber of Commerce & Industry.

Brian provides an initial confidential consultation to:

• Assist you in evaluating existing pensions, protection (insurance) and savings / investment provision in a comprehensible manner.

• Identify and prioritise your financial objectives (short, medium and long-term).

• Identify how to reach those objectives, on the basis of resources you can comfortably engage. Importantly, he will focus on present and future tax-efficiency, product portability, your attitude to risk and events that may threaten the financial wellbeing of you and your dependents.

Next he will prepare a report recommending solutions matching your requirements and include any relevant product literature and illustrations to enable you to make an informed decision. Crucially, Spectrum are not agents for any particular company- representing clients from an unbiased position of independence. We feel that this strongly sets us apart from dealing directly with large institutions, where you may experience less-personal service, a high turnover of staff familiar with your circumstances and where there may be a bias to recommend their own products and services.

Spectrum’s recommendations are made without obligation or charge. You are free to accept our advice wholly, partly or not at all. We are pleased also to negotiate and arrange access to holdings specifically of your choice.

|

Why use Currencies Direct? - the benefits.

Challenging traditional banking conventions, Currencies Direct guarantees to beat any retail bank both in price and service. From the moment we were established our aim has been simple. To provide a personalised service and save our clients money from dealing with traditional banks.

- Increasing your spending power. Because we deal directly with the currency markets we can offer the best foreign money exchange rates that the banks find hard to beat. These great foreign currency exchange rates mean that you get more for your money.

- Saving you money. We want to make sure that you get the best forex deals you can so that's why we offer all our clients free transfers (over £5,000) and charge no commission. Plus, Currencies Direct does not charge lifting/receiving fees on forex transfers.

- Tailored to your circumstances. As specialist foreign exchange brokers we are able to offer a number of product choices for foreign exchange including spot deals, forward contracts and limit orders. Which one is right for you will depend on your circumstances, foreign currency needs and timing.

- Easy to deal with. You can trade in forex with us by phone, talking directly to a currency specialist, electronically or by fax. The first step is to become a registered private or business customer. Our registration process is second to none. You can register with us online and be ready to trade in minutes.

- Make regular payments overseas. Mortgage, maintenance, insurance - whatever your reason for making regular money transfers Currencies Direct's Overseas Regular Money Transfer Plan can save you money. With free forex transfers, great foreign exchange rates and low minimum amounts we really make is easy to keep benefiting from our great service. Click here for more information.

- For businesses, we are committed to delivering excellence in customer service and solutions to help your business grow and compete more effectively within the global market place.

Currencies Direct Limited is a leading payment technology solutions company and it was one of Europe's first independent foreign exchange specialists in 1996 to recognise the need in the market for an expert secondary Foreign Exchange provider to traditional banks. Its innovative approach is based on dealing directly with the currency markets and matching buyers with sellers thus eliminating intermediaries and giving it a competitive edge in pricing foreign exchange. Twelve years on Currencies Direct is now one of Europe's largest foreign exchange specialist with a head office and operations across 5 continents, with 2,000 strong franchise network of business partners and is part of the Azibo Group.

Trust a specialist to Get it Right on Overseas Transfers

Many of us send money abroad for various reasons. Anything from emigrating; purchasing a holiday home; paying a mortgage or covering monthly business costs, we do this through the obvious vehicle - our bank. The disappointing factor with this choice is we lose money every time we do this, either through bank charges such as transfer fees or through poor foreign exchange rates. Naturally we all trust our bank to handle financial matters, but we don’t consider other options for transferring funds abroad, most probably because we aren’t aware of the benefits of using a specialist foreign exchange provider.

For those who are aware of the charges from the bank and negotiate a better deal; need to consider that banks are often prepared to waive their fee or charges because they can make a substantial profit on offering a poor foreign exchange rate. So however you look at it the banks make money and you lose money on international transfers, the larger the transfer, the more you have to lose.

Every year at Currencies Direct we see new clients joining us; it never ceases to astonish us how much money our clients lose through banks and how much they saved through our services especially on large transfers* or small regular overseas payments. We charge no fees for transfers over £5000 and regular transfers are also fee-free.

You will wonder how businesses like our own make money if you are saving so much? This is simple, we buy £2bn worth of foreign exchange each year so we are able to purchase our currency at wholesale rates. We pass on most of these savings to you, retaining a small margin for ourselves. We guarantee to always beat the banks on exchange rates.

Transferring your funds overseas is very straightforward with Currencies Direct. We process 220 000 payments a year so we have the expertise to make payments swiftly and painlessly. As soon as we receive your funds, we send out the payment immediately to the bank account details you have provided. We send payments to bank accounts in 50 countries and trade in 45 different currencies giving you a wide choice of where you can make transfers.

Working as a specialist broker gives us the advantage of finding the best rates for you and offering you a more personal service, we have numerous solutions that can be tailored to meet your needs. Once you have registered for our service you will receive a personal dealer who will handle your foreign exchange payments, their job is to ensure you receive the best rates as well as giving you the option of buying the rate now or when it meets a target set by you and the dealer. The dealer will discuss with you the best option for your needs. You can make international transfers by speaking to your dealer and agreeing a contract or you can use our online system iPayFX.

Currencies Direct offer a wide range of services to assist you with your international payments. The bottom line is – your best interests are our focus.

Written by Karl Sieha, Currencies Direct

*Currencies Direct can typically save clients up to three per cent of the overall amount of money being transferred compared to mainstream banks. And, unlike most other exchanges, it does not charge a commission and waives its transaction fee on deals above £5,000.

Partners

A PLACE IN THE SUN LIVE

If you're thinking of buying a property in France, you can't afford to miss

The French Village at A Place in the Sun Live on

28th-30th September 2012, NEC Birmingham

The experts on France, French-Property.com, work in association with A Place in the Sun to host the boutique French Village at our forthcoming exhibition.

The French Village at A Place in the Sun Live, combines a mix of agents and developers with thousands of French properties for sale from across the country, alongside a detailed seminar programme featuring advice from French property experts and Q&A sessions. Together, the experts in the village will ensure that the committed Francophile is up to speed on all aspects of buying property and living in France.

Editor of French-Property.com, David Yeates, will be chairing a series of presentations from industry experts on how to buy property and live in France. It's vital to understand everything from tax and healthcare issues through to the legal pitfalls to avoid before you embark on your property purchase. That's why we've got the specialists on-hand to give you insider knowledge such as Duncan Campbell from Siddalls Financial Services and David Johnson from Halo Financial.

And if you just want to get a feel for what it's like to actually live in France, then don't miss Joanna Leggett from Leggett Immobilier's session each day where she'll be telling you what its really like to learn the language, get around and mix with the locals in this wonderful country.

And of course there are hundreds of beautiful French properties to whet your appetite.

Make sure you come prepared to ask plenty of questions - we challenge you to ask our experts something they don't know!

A Place in the Sun Live is the perfect place to seek information and meat professionals when you're thinking of buying a property overseas.

There's also a packed schedule of free-to-attend seminar sessions, where experts from across the industry will be talking about the things that are important to you when buying a home abroad. There are sessions on everything from transferring your currency when buying a property in France, to what healthcare and pension entitlements you can expect in Cyprus and almost everything in between.A Place in the Sun Live is a great informal atmosphere where you can meet agents and take the time to ask all the questions you want answered so you can compare and contrast the different properties and deals on offer.

The Main Stage sponsored by MBi Consulting is at the heart of the action where our TV presenters Amanda Lamb, Jasmine Harman and Jonnie Irwin will be sharing their experiences of house-huning overseas - all the sessions are free, just get there early if you want a seat!

The Buying Advice Seminar Theatre sponsored by HomeAway.co.uk will offer seminar sessions on buying in Spain, Cyprus and Turkey, as well as sessions on financing your property and emigration.

There are also series of country-themed villages and pavilion areas within the show with dedicated seminar theatres, where you can get specific advice on the most popular destinations to buy a property abroad.

The French Village in association with the experts on France, French-Property.com and sponsored by Halo Financial has its own dedicated seminar theatre and is surrounded by agents selling property from all four corners of France. Plus there are experts on tax, healthcare and all the other important topics you need to understand before buying a property in France.

The French Village at London's Earls Court

French-Property.com will be hosting their popular ‘French Village’ at A Place in the Sun Live exhibition at London's Earls Court, 30th March - 1st April.

A Place in the Sun Live is the largest overseas property exhibition in the UK and our French Village is a major display area at the event.

As well as offering a selection of properties from agents and private vendors across France, there will be an opportunity to hear from a range of specialist speakers on buying property and living in France.

Amongst the exhibitors will be Halo Financial, Siddalls Financial Advisors Ltd, Leggett Immobilier, Furley Page Solicitors, Soficas Medical Insurers, Richard Immobilier, International Private Finance, Le Bonheur Immobilier, Charente Immobilier, and Move Vitesse Removals

There is a packed seminar programme for the three days of the show, with rolling presentations from expert speakers, together with ‘Ask the Experts’ panel sessions.

The seminars will cover some of the key issues of concern to French property buyers:

- Legal process of Buying Property

- French Taxation and Inheritance

- Health Cover

- Currency Management

- Living in France

- Getting a Mortgage

The seminars will be overseen by David Yeates, News Editor of French-Property.com.

They will be free to attend on a first come, first served basis.

French-Property.com will be offering a free ‘Guide to Buying Property in France’, and visitors will also be able to meet the team to discuss their French property needs and aspirations.

French-Property.com is one of the leading Anglophone sites for property listings in France, with around 13,000 properties and over 100 agents on our site.

In recent years we have also developed an authoritative source of information and advice on buying property and living in France, through our Guides to France and Newsletter.

French Village Shines at A Place in the Sun Live NEC 2011

A strong turnout last weekend at the French Village, A Place in the Sun Live, does suggest that the tide may well be turning on interest in buying property in France.

Pat Monk, Managing Director of French-Property.com stated, 'This was the fourth occasion when we have hosted the French Village at the APITS property exhibition. Given the current climate, it was also one we approached with a fair degree of apprehension.

So it was with great delight and surprise to find that when the doors to the exhibition opened on Friday morning we were quickly overrun with dozens of visitors looking for a property to buy, and for further information on living in France.'

Over the whole of the three day event, we estimate between 1500 and 2000 people called in on the French Village.

Not only were there particulars available on hundreds of properties for sale, but also estate agents and experts on hand to discuss all aspects of buying property and living in France.

A large number of the seminars we ran over the three days were completely full, with standing room only in many cases.

Perhaps of as much interest as the turnout was the quality of those who came along to the show, with the vast majority of visitors clearly very interested in relocating to France, determined to learn as much about how best to do it and what to expect.

John Richardson of French mortgage brokers International Private Finance Ltd, one of the exhibitors in the French Village, stated that, ‘Despite the negative headlines currently dominating the press it was refreshing to see first-hand the enthusiasm that remains amongst potential buyers of second homes in France.’

‘The show also provided a great opportunity to speak to potential buyers face-to-face and understand what information they are looking for, where they are looking to buy, and concerns they may have regarding the process and the availability of French mortgages,’ he stated.

A similar view was expressed by

Tony Mason of medical insurance brokers Soficas.

’We were amazed to at the size of the turnout for our seminar presentations and the clear level of interest that those who attended expressed in finding out more about their health insurance options when they relocate to France’, he stated.

For Sarah Bogard of solicitors Furley Page 'The exhibition is a major event in the calendar and the Birmingham show was once again a great success. Our legal team met many people to talk about their ambitions to move over to France to live, as well as a good number in search of a holiday home. We find the French Village a fantastic one stop shop for all the key information required for anyone considering such a life changing move.'

Sally Stone of property management company Les Bons Voisins stated, 'Our company prides itself on doing what it says on the tin, so I can only say how pleased we are to be part of the French Village at A Place in the Sun exhibitions. Under the overall umbrella of French-Property.com the breadth of information and assistance available to visitors is second to none.'

David Johnson, Director of Halo Financial Ltd, currency brokers and sponsors of the French Village also considered that there was a definite increase in interest in buying property in France.'We took more enquiries on the first day of the exhibition than we did over the three days of the London exhibition in March. There is no doubting it; despite the uncertainty that is around, France is getting back on track.’

Partners

Health cover in France - A few definitions

A FEW DEFINITIONS

Understanding The French System:

Unlike the English system, the French regime makes no difference between the public and private treatments

(the reimbursement rates are identical).

On the other-hand, the 'Sécurité Sociale' alone does not cover the entirety of your expenses.

First column represents the total cost of your medical treatment.

Second column shows the possible reimbursements:

Orange = reimbursable with minimum cover

Orange to Red = Only reimbursable with higher cover or not at all.

Third column indicates where the reimbursements could come from.

Click on each column to see their individual definitions:

Frais Médicaux :

The TOTAL amount charged for your treatment.

This can be a Fixed rate or an amount announced by a specialist.