Partners

Health cover in France - How does it work ?

-

HOW DOES IT WORK

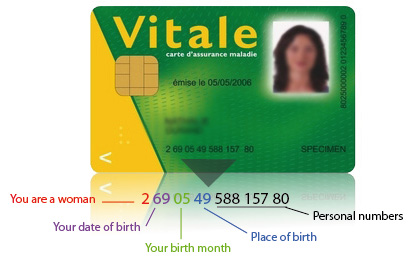

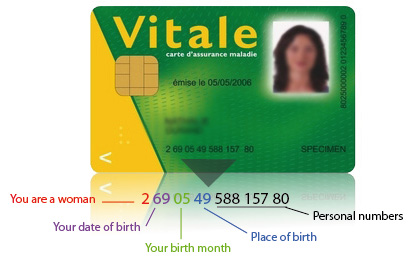

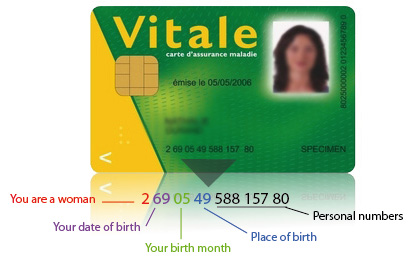

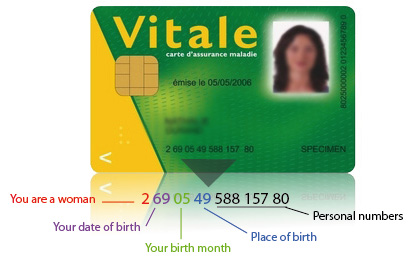

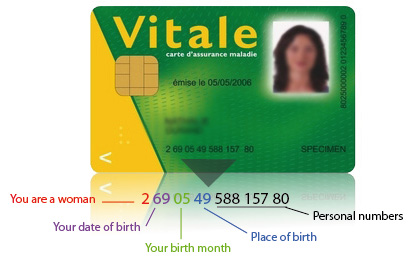

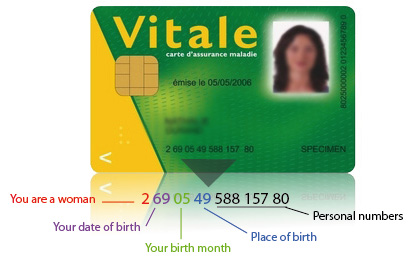

Know your number off by heart !

In the event that you are taken ill without you personal

belongings, just by telling you "numéro de Sécurité Sociale"

the medical services will have enough information to get started.

The first number designates your sex, 1 for men and 2 for women.

For temporary numbers starting with 5, 6, 7 or 8 this logic does not apply.

The next four numbers indicate your year and month of birth.

Your "insee" number will probably be followed by 99 for foreigners.

This number is replaced by the department code if you were born in France.

e.g.: 24 if you were born in the Dordogne.

Finally, a series of 8 numbers show what “CPAM” office treats your dossiers.

"How to use your "Carte Vitale" & "Top-Up"

When you have medical treatment in France, you are usually asked for your “CARTE VITALE” (from CPAM or RSI) and the slip of paper called “Tiers payant complémentaire or Mutuelle" (from your Top-Up). Usually no money is asked for. The bill will be sent to “CPAM” (Caisse Primaire d’Assurance Maladie or other if selfemployed) and your TOP-UP.

When only your Carte Vitale is asked for this is usually because there is the possibility of using the “Télétransmission” (automatic payment and reimbursement system). You will have to pay either the total amount (eg: GP, Dentist) or just the “Ticket Modérateur” difference between the CPAM allowance and the “Tarif de convention” (100%

base rate (what the state says your treatment is worth).

CPAM will proceed with their partial reimbursement and send the information(normally) to your Top-Up by Télétransmission.

Your Top-Up will in turn reimburse the difference depending on your chosen level of cover.

In some cases you will have to pay for excess charges that the “Médecin Spécialiste” has over the state convention rate. These are called in French “Dépassements d’honoraires”.

These charges can be claimed from your Top-up by sending the an acquitted bill. (! If your level of guarantee covers such charges).

If the CPAM does not reimburse medical treatment then the Top-up will not either, unless otherwise stated by annual flat rate.

(eg: Private room, glasses, spa, flu injection, etc.)

How to use "Feuille de Soins" or "Factures"

When your “Carte Vitale” is not used, papers called “FEUILLES DE SOINS” are given to you.

The information on these papers is identical to the information given by your “Carte Vitale”.

These forms have to be filled in and sent to the CPAM office dealing with your reimbursements.

! Please make sure you fill in your Social security number (also called numéro d’immatriculation) and sign the paperwork at the bottom.

If for whatever reason the Top-up takes time reimbursing their part on reception of the CPAM statement itemising your last reimbursements, send these to your Top-up.

(This replaces the Télétransmission should CPAM not have sent the information in the first place).

As soon as your Top-up has the correct information they too can reimburse their part.

N.B: If you send your paperwork directly to your insurance company, then the reimbursements will be a lot quicker than if you send them to your brokers, “SOFICA’s”. Please, do not forget to indicate your contract number.

Partners

Health cover in France - How does it work ?

-

HOW DOES IT WORK

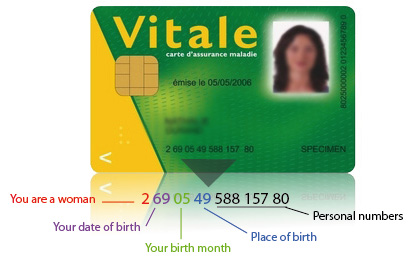

Know your number off by heart !

In the event that you are taken ill without you personal

belongings, just by telling you "numéro de Sécurité Sociale"

the medical services will have enough information to get started.

The first number designates your sex, 1 for men and 2 for women.

For temporary numbers starting with 5, 6, 7 or 8 this logic does not apply.

The next four numbers indicate your year and month of birth.

Your "insee" number will probably be followed by 99 for foreigners.

This number is replaced by the department code if you were born in France.

e.g.: 24 if you were born in the Dordogne.

Finally, a series of 8 numbers show what “CPAM” office treats your dossiers.

"How to use your "Carte Vitale" & "Top-Up"

When you have medical treatment in France, you are usually asked for your “CARTE VITALE” (from CPAM or RSI) and the slip of paper called “Tiers payant complémentaire or Mutuelle" (from your Top-Up). Usually no money is asked for. The bill will be sent to “CPAM” (Caisse Primaire d’Assurance Maladie or other if selfemployed) and your TOP-UP.

When only your Carte Vitale is asked for this is usually because there is the possibility of using the “Télétransmission” (automatic payment and reimbursement system). You will have to pay either the total amount (eg: GP, Dentist) or just the “Ticket Modérateur” difference between the CPAM allowance and the “Tarif de convention” (100%

base rate (what the state says your treatment is worth).

CPAM will proceed with their partial reimbursement and send the information(normally) to your Top-Up by Télétransmission.

Your Top-Up will in turn reimburse the difference depending on your chosen level of cover.

In some cases you will have to pay for excess charges that the “Médecin Spécialiste” has over the state convention rate. These are called in French “Dépassements d’honoraires”.

These charges can be claimed from your Top-up by sending the an acquitted bill. (! If your level of guarantee covers such charges).

If the CPAM does not reimburse medical treatment then the Top-up will not either, unless otherwise stated by annual flat rate.

(eg: Private room, glasses, spa, flu injection, etc.)

How to use "Feuille de Soins" or "Factures"

When your “Carte Vitale” is not used, papers called “FEUILLES DE SOINS” are given to you.

The information on these papers is identical to the information given by your “Carte Vitale”.

These forms have to be filled in and sent to the CPAM office dealing with your reimbursements.

! Please make sure you fill in your Social security number (also called numéro d’immatriculation) and sign the paperwork at the bottom.

If for whatever reason the Top-up takes time reimbursing their part on reception of the CPAM statement itemising your last reimbursements, send these to your Top-up.

(This replaces the Télétransmission should CPAM not have sent the information in the first place).

As soon as your Top-up has the correct information they too can reimburse their part.

N.B: If you send your paperwork directly to your insurance company, then the reimbursements will be a lot quicker than if you send them to your brokers, “SOFICA’s”. Please, do not forget to indicate your contract number.

Partners

Top-Up health insurance

ASAF/AFPS/GIEPS

950 route des Colles

Les Templiers

06410 - BIOT

ASAF (Association Santé et Action Familiale)

AFPS (Action Familiale de Prévoyence Sociale)

Established in 1974 with the objective of making accessible, Top-Up health covers to everyone, whatever their age, their personal situation or their particular health needs.

ASAF’s human resources and technical dispositions are supported by GIEPS (Groupement d'Intérêt Économique de Prévoyance Sociale) this gives us the possibility to maintain a sensibly sized structure with around 180 employees offering to adherents the best possible services.

At the end of 2010, ASAF & AFPS had 251 000 members.

The reputation of secure insurer since the beginning, the group contract with AXA guaranteed financial solidarity to the durability to ASAF.

Top-Up, Régime Complémentaire or Mutuelle.

Most medical treatments are only partially covered by the régime obligatoire and some not at all. It is French way of life to take out an additional insurance that works hand-in-glove with the French regime obligatoires to reduce or eliminate such shortfalls.

Different levels of cover, adapted to different needs and especially for different budgets. It is important to understand that French Top-Ups are designed to cover expensive unplanned medical bills incurred during treatment and not just to get a new set of dentures. Unlike any other insurance, it is not because one person makes a claim that their premiums will increase. Effectively in comparison, you could say that people in good health pay for people in need of treatment. The Top-Up system is based on “solidarity” like the CPAM. To stop your premiums shooting through the roof should you fall seriously ill, the costs will spread out annually to all clients, thus making Top-Up insurance accessible to everyone. Those that are unable to afford Top-Up are granted help from the government called ACS to contribute towards a Top-Up proving how important it is to take out such insurance.

Top-Ups starts at 100% of the base de convention and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICAS recommends middle of the range cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for other medical treatment as some base rates are very low.

Partners

Health cover in France - How does it work ?

-

HOW DOES IT WORK

Know your number off by heart !

In the event that you are taken ill without you personal

belongings, just by telling you "numéro de Sécurité Sociale"

the medical services will have enough information to get started.

The first number designates your sex, 1 for men and 2 for women.

For temporary numbers starting with 5, 6, 7 or 8 this logic does not apply.

The next four numbers indicate your year and month of birth.

Your "insee" number will probably be followed by 99 for foreigners.

This number is replaced by the department code if you were born in France.

e.g.: 24 if you were born in the Dordogne.

Finally, a series of 8 numbers show what “CPAM” office treats your dossiers.

"How to use your "Carte Vitale" & "Top-Up"

When you have medical treatment in France, you are usually asked for your “CARTE VITALE” (from CPAM or RSI) and the slip of paper called “Tiers payant complémentaire or Mutuelle" (from your Top-Up). Usually no money is asked for. The bill will be sent to “CPAM” (Caisse Primaire d’Assurance Maladie or other if selfemployed) and your TOP-UP.

When only your Carte Vitale is asked for this is usually because there is the possibility of using the “Télétransmission” (automatic payment and reimbursement system). You will have to pay either the total amount (eg: GP, Dentist) or just the “Ticket Modérateur” difference between the CPAM allowance and the “Tarif de convention” (100%

base rate (what the state says your treatment is worth).

CPAM will proceed with their partial reimbursement and send the information(normally) to your Top-Up by Télétransmission.

Your Top-Up will in turn reimburse the difference depending on your chosen level of cover.

In some cases you will have to pay for excess charges that the “Médecin Spécialiste” has over the state convention rate. These are called in French “Dépassements d’honoraires”.

These charges can be claimed from your Top-up by sending the an acquitted bill. (! If your level of guarantee covers such charges).

If the CPAM does not reimburse medical treatment then the Top-up will not either, unless otherwise stated by annual flat rate.

(eg: Private room, glasses, spa, flu injection, etc.)

How to use "Feuille de Soins" or "Factures"

When your “Carte Vitale” is not used, papers called “FEUILLES DE SOINS” are given to you.

The information on these papers is identical to the information given by your “Carte Vitale”.

These forms have to be filled in and sent to the CPAM office dealing with your reimbursements.

! Please make sure you fill in your Social security number (also called numéro d’immatriculation) and sign the paperwork at the bottom.

If for whatever reason the Top-up takes time reimbursing their part on reception of the CPAM statement itemising your last reimbursements, send these to your Top-up.

(This replaces the Télétransmission should CPAM not have sent the information in the first place).

As soon as your Top-up has the correct information they too can reimburse their part.

N.B: If you send your paperwork directly to your insurance company, then the reimbursements will be a lot quicker than if you send them to your brokers, “SOFICA’s”. Please, do not forget to indicate your contract number.

Partners

Top-Up health insurance

ASAF/AFPS/GIEPS

950 route des Colles

Les Templiers

06410 - BIOT

ASAF (Association Santé et Action Familiale)

AFPS (Action Familiale de Prévoyence Sociale)

Established in 1974 with the objective of making accessible, Top-Up health covers to everyone, whatever their age, their personal situation or their particular health needs.

ASAF’s human resources and technical dispositions are supported by GIEPS (Groupement d'Intérêt Économique de Prévoyance Sociale) this gives us the possibility to maintain a sensibly sized structure with around 180 employees offering to adherents the best possible services.

At the end of 2010, ASAF & AFPS had 251 000 members.

The reputation of secure insurer since the beginning, the group contract with AXA guaranteed financial solidarity to the durability to ASAF.

Top-Up, Régime Complémentaire or Mutuelle.

Most medical treatments are only partially covered by the régime obligatoire and some not at all. It is French way of life to take out an additional insurance that works hand-in-glove with the French regime obligatoires to reduce or eliminate such shortfalls.

Different levels of cover, adapted to different needs and especially for different budgets. It is important to understand that French Top-Ups are designed to cover expensive unplanned medical bills incurred during treatment and not just to get a new set of dentures. Unlike any other insurance, it is not because one person makes a claim that their premiums will increase. Effectively in comparison, you could say that people in good health pay for people in need of treatment. The Top-Up system is based on “solidarity” like the CPAM. To stop your premiums shooting through the roof should you fall seriously ill, the costs will spread out annually to all clients, thus making Top-Up insurance accessible to everyone. Those that are unable to afford Top-Up are granted help from the government called ACS to contribute towards a Top-Up proving how important it is to take out such insurance.

Top-Ups starts at 100% of the base de convention and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICAS recommends middle of the range cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for other medical treatment as some base rates are very low.

Partners

ADMINISTRATIVE MATTERS

CLICK TO VISIT |

Furley Page Solicitors

39 St Margaret's Street

Canterbury

Kent

CT12TX

|

Sarah Bogard: 0044 (0) 1227 763 939

Florence Richards: 0044 (0) 1227 763 939

Anna Berry :0044 (0) 1227 763 939

|

The Basics of Buying French Property

- The process of buying French property is quite different to buying a property in the UK.

- Having a survey done is not obligatory, but recommended because the French property is “vendue en l’état” (sold as seen) which means that you take the property with any hidden defects which you could have discovered by searches or inspections.

- The price, sale of any chattels (furniture etc) and conditions of the contract are agreed with the seller.

- The seller produces a set of reports for you known as the “Dossier Diagnostique Technique”.

The obligatory reports, depending on age and location of property, include those on the presence of asbestos, termites, lead in the paintwork, and risks in the local area (such as flooding or landslides). For co-ownership properties (“copropriété”) will also be included a report confirming the size of the property to be sold if it is more than 8 square metres. Note that reports have only a certain length of validity (e.g. termites report is only valid for 6 months) so check the dates of the reports carefully. You can also make your own enquiries at the “Mairie” (town hall) to find out if an area is susceptible to termites or environmental risks etc.

- The process quickly moves to the signing of the first contract (“compromis de vente”) at which point a deposit (usually 5-10% of purchase price) is paid. This is a binding contract.

The “compromis de vente” is either drawn up by the estate agent in charge of the sale, or the notaire is instructed to draft it. This document contains a lot of information about the property and the surrounding area. It includes conditions precedent (“conditions suspensives”), which must be fulfilled in order for completion to take place. There are standard conditions that are included (such as the condition that the title deeds do not show any charges registered on the property other than those that will be paid from the sale proceeds) but sometimes it is advisable to include others. For example, if you want to develop the land you could request a condition that planning permission (or preliminary permission) is granted before you can complete to ensure you can do what you intend with the property.

- If you are a “non-professional” purchasing a residential property or land for residential construction, you benefit from a 7 day cooling off period after having signed the “compromis de vente”. If you decide that you no longer wish to purchase the property, you can serve notice on the seller. There is a very short time limit and if you have any concerns about the property you should ideally resolve them before signing the contract.

- You should investigate mortgage options at an early stage. If you decide to apply for a mortgage, it will be a condition of the sale that you obtain a mortgage offer, but you must comply with strict time frames for your application in order to benefit from this condition.

- It usually takes about 2 to 3 months between signature of the “compromis de vente” and the completion deed (“acte de vente”). During this time, the notaire carries out his searches and you get your mortgage arranged. The notaire will then confirm the date of completion.

Please note that the notaire represents both the seller and the buyer and he acts impartially. You are free to appoint your own notaire, at no additional cost as the notaires have to share the fees between them. The notaire’s fees are calculated on a set scale (not freely negotiated with you) based on the value of the property. The notaire’s fees are usually paid by the buyer. The notaire will hold the purchase funds in an account pending completion. You must ensure that the funds are paid to a designated account, and it is preferable to pay to the notaire rather than the estate agent. It is recommended that you get legal advice on how best to structure your legal ownership of the property, taking into account various inheritance rules on death and inheritance tax.

- You can give power to attorney to someone to sign on your behalf, but it is recommended that you make a last inspection of the property before completion of the transaction takes place. It is also possible that there may be last minute amendments to the ”acte de vente”.

- On completion day, the final balance of the purchase price is paid, you are given the keys to the property and an “attestation de vente”. Registration of ownership can take up to 6 months to complete.

- You must organise insurance from the date of completion, and sort out reading meters and getting service contracts with utility providers.

For further information please contact Sarah Bogard.

CLICK TO VISIT |

Your French Matters17 rte. du Grallet

17920 - BREUILLET | Laura MORLEY

Telephone: 06 79 14 21 03

yourfrenchmatters@gmail.com

|

Help and Advice for all your Professional and Personal Administrative Matters

I have lived with my family in France for eight years. We began our adventure in the Charente area of France but relocated to the Charente Maritime and the coast in 2006. In the UK, I was a primary school teacher and upon moving to France studied and gained a diploma with honours to Teach English as a Foreign Language (TEFL).

As well as giving English lessons to French individuals, I had my own retail enterprise and have spent 4 years in a chartered Accountancy firm as head of the foreign section, completing over 200 income tax declarations annually and dealing with all administrative issues encountered by the UK expatriate in France.

Local Taxes: I have studied local tax impositions and verification of the French Tax Foncière and Tax d’Habitation in order to check that the tax impositions are based on realistic information and requesting recalculation when appropriate.

Business Setup: I give help and advice on grants and financial help available for business set up and personal situations with the CAF (social security and family allowance organisation in France).

I help people to understand, register and run their business under the micro regime and auto entrepreneur regime and help deal with the social organisations such as RSI and URSSAF.

Sworn Translations: I am a sworn translator via the TRIBUNAL DE GRANDE INSTANCE de SAINTES and have recently been awarded accreditation to complete and certify Capital gains declarations.

Tax Reimbursement: I also deal with obtaining reimbursement of tax paid twice for clients that relocate to France from the UK or other European countries and dealing with pension forecasts and other administrative issues involving the relocation from one country to another.

Works Undertaken: Annual French Income Tax returns (residents and non residents), Completion of UK administrative forms (P85, R105, France Individual etc), Help understanding Social charges and Social Contributions, Business registration and advice under the Micro regime or the Auto entrepreneur scheme, Issues surrounding local taxes such as Taxe Foncière & Taxe d'Habitation, Help with planning permissions, Certified and Sworn Translations (registration via the Tribunal in Saintes)

No matter how many books one reads or how much advice one seeks from others who have made the move to France sadly there are always pitfalls.

My customers save a great deal of time and stress by using my service, that's what they tell me, and I can see the relief on their faces. I am Rachel Gallard, a French National and I am tri-lingual; I also speak German fluently. Having lived and worked in the Channel Islands for many years I can understand the frustrations felt by my UK clients trying to deal with another culture, in particular - the French way.

The French approach to business and service can be hard to comprehend even for the French, so I have developed an accurate and up-to-date knowledge of the system, I spend my time ensuring the answers are in place before the questions arise.

Anglo‑French Communication is registered with the French authorities and as such is legally required to meet their standards in providing a legitimate and accurate service to customers.

Through Anglo‑French Communication my clients have easy access to other professionals who I trust and work with, here in Brittany. Even if your problem is utterly unique, you have our combined experience to draw on for a fast and effective solution to any headache.

The stories are true, every branch of the French civil service adores red tape and paperwork, let us handle the administration while you enjoy your new life in France!

We provide high quality services to individuals and all types of businesses paying close attention to the needs of each client.

Partners

Health cover in France - How does it work ?

-

HOW DOES IT WORK

Know your number off by heart !

In the event that you are taken ill without you personal

belongings, just by telling you "numéro de Sécurité Sociale"

the medical services will have enough information to get started.

The first number designates your sex, 1 for men and 2 for women.

For temporary numbers starting with 5, 6, 7 or 8 this logic does not apply.

The next four numbers indicate your year and month of birth.

Your "insee" number will probably be followed by 99 for foreigners.

This number is replaced by the department code if you were born in France.

e.g.: 24 if you were born in the Dordogne.

Finally, a series of 8 numbers show what “CPAM” office treats your dossiers.

"How to use your "Carte Vitale" & "Top-Up"

When you have medical treatment in France, you are usually asked for your “CARTE VITALE” (from CPAM or RSI) and the slip of paper called “Tiers payant complémentaire or Mutuelle" (from your Top-Up). Usually no money is asked for. The bill will be sent to “CPAM” (Caisse Primaire d’Assurance Maladie or other if selfemployed) and your TOP-UP.

When only your Carte Vitale is asked for this is usually because there is the possibility of using the “Télétransmission” (automatic payment and reimbursement system). You will have to pay either the total amount (eg: GP, Dentist) or just the “Ticket Modérateur” difference between the CPAM allowance and the “Tarif de convention” (100%

base rate (what the state says your treatment is worth).

CPAM will proceed with their partial reimbursement and send the information(normally) to your Top-Up by Télétransmission.

Your Top-Up will in turn reimburse the difference depending on your chosen level of cover.

In some cases you will have to pay for excess charges that the “Médecin Spécialiste” has over the state convention rate. These are called in French “Dépassements d’honoraires”.

These charges can be claimed from your Top-up by sending the an acquitted bill. (! If your level of guarantee covers such charges).

If the CPAM does not reimburse medical treatment then the Top-up will not either, unless otherwise stated by annual flat rate.

(eg: Private room, glasses, spa, flu injection, etc.)

How to use "Feuille de Soins" or "Factures"

When your “Carte Vitale” is not used, papers called “FEUILLES DE SOINS” are given to you.

The information on these papers is identical to the information given by your “Carte Vitale”.

These forms have to be filled in and sent to the CPAM office dealing with your reimbursements.

! Please make sure you fill in your Social security number (also called numéro d’immatriculation) and sign the paperwork at the bottom.

If for whatever reason the Top-up takes time reimbursing their part on reception of the CPAM statement itemising your last reimbursements, send these to your Top-up.

(This replaces the Télétransmission should CPAM not have sent the information in the first place).

As soon as your Top-up has the correct information they too can reimburse their part.

N.B: If you send your paperwork directly to your insurance company, then the reimbursements will be a lot quicker than if you send them to your brokers, “SOFICA’s”. Please, do not forget to indicate your contract number.

Partners

Top-Up health insurance

ASAF/AFPS/GIEPS

950 route des Colles

Les Templiers

06410 - BIOT

ASAF (Association Santé et Action Familiale)

AFPS (Action Familiale de Prévoyence Sociale)

Established in 1974 with the objective of making accessible, Top-Up health covers to everyone, whatever their age, their personal situation or their particular health needs.

ASAF’s human resources and technical dispositions are supported by GIEPS (Groupement d'Intérêt Économique de Prévoyance Sociale) this gives us the possibility to maintain a sensibly sized structure with around 180 employees offering to adherents the best possible services.

At the end of 2010, ASAF & AFPS had 251 000 members.

The reputation of secure insurer since the beginning, the group contract with AXA guaranteed financial solidarity to the durability to ASAF.

Top-Up, Régime Complémentaire or Mutuelle.

Most medical treatments are only partially covered by the régime obligatoire and some not at all. It is French way of life to take out an additional insurance that works hand-in-glove with the French regime obligatoires to reduce or eliminate such shortfalls.

Different levels of cover, adapted to different needs and especially for different budgets. It is important to understand that French Top-Ups are designed to cover expensive unplanned medical bills incurred during treatment and not just to get a new set of dentures. Unlike any other insurance, it is not because one person makes a claim that their premiums will increase. Effectively in comparison, you could say that people in good health pay for people in need of treatment. The Top-Up system is based on “solidarity” like the CPAM. To stop your premiums shooting through the roof should you fall seriously ill, the costs will spread out annually to all clients, thus making Top-Up insurance accessible to everyone. Those that are unable to afford Top-Up are granted help from the government called ACS to contribute towards a Top-Up proving how important it is to take out such insurance.

Top-Ups starts at 100% of the base de convention and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICAS recommends middle of the range cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for other medical treatment as some base rates are very low.

Partners

ADMINISTRATIVE MATTERS

CLICK TO VISIT |

Furley Page Solicitors

39 St Margaret's Street

Canterbury

Kent

CT12TX

|

Sarah Bogard: 0044 (0) 1227 763 939

Florence Richards: 0044 (0) 1227 763 939

Anna Berry :0044 (0) 1227 763 939

|

The Basics of Buying French Property

- The process of buying French property is quite different to buying a property in the UK.

- Having a survey done is not obligatory, but recommended because the French property is “vendue en l’état” (sold as seen) which means that you take the property with any hidden defects which you could have discovered by searches or inspections.

- The price, sale of any chattels (furniture etc) and conditions of the contract are agreed with the seller.

- The seller produces a set of reports for you known as the “Dossier Diagnostique Technique”.

The obligatory reports, depending on age and location of property, include those on the presence of asbestos, termites, lead in the paintwork, and risks in the local area (such as flooding or landslides). For co-ownership properties (“copropriété”) will also be included a report confirming the size of the property to be sold if it is more than 8 square metres. Note that reports have only a certain length of validity (e.g. termites report is only valid for 6 months) so check the dates of the reports carefully. You can also make your own enquiries at the “Mairie” (town hall) to find out if an area is susceptible to termites or environmental risks etc.

- The process quickly moves to the signing of the first contract (“compromis de vente”) at which point a deposit (usually 5-10% of purchase price) is paid. This is a binding contract.

The “compromis de vente” is either drawn up by the estate agent in charge of the sale, or the notaire is instructed to draft it. This document contains a lot of information about the property and the surrounding area. It includes conditions precedent (“conditions suspensives”), which must be fulfilled in order for completion to take place. There are standard conditions that are included (such as the condition that the title deeds do not show any charges registered on the property other than those that will be paid from the sale proceeds) but sometimes it is advisable to include others. For example, if you want to develop the land you could request a condition that planning permission (or preliminary permission) is granted before you can complete to ensure you can do what you intend with the property.

- If you are a “non-professional” purchasing a residential property or land for residential construction, you benefit from a 7 day cooling off period after having signed the “compromis de vente”. If you decide that you no longer wish to purchase the property, you can serve notice on the seller. There is a very short time limit and if you have any concerns about the property you should ideally resolve them before signing the contract.

- You should investigate mortgage options at an early stage. If you decide to apply for a mortgage, it will be a condition of the sale that you obtain a mortgage offer, but you must comply with strict time frames for your application in order to benefit from this condition.

- It usually takes about 2 to 3 months between signature of the “compromis de vente” and the completion deed (“acte de vente”). During this time, the notaire carries out his searches and you get your mortgage arranged. The notaire will then confirm the date of completion.

Please note that the notaire represents both the seller and the buyer and he acts impartially. You are free to appoint your own notaire, at no additional cost as the notaires have to share the fees between them. The notaire’s fees are calculated on a set scale (not freely negotiated with you) based on the value of the property. The notaire’s fees are usually paid by the buyer. The notaire will hold the purchase funds in an account pending completion. You must ensure that the funds are paid to a designated account, and it is preferable to pay to the notaire rather than the estate agent. It is recommended that you get legal advice on how best to structure your legal ownership of the property, taking into account various inheritance rules on death and inheritance tax.

- You can give power to attorney to someone to sign on your behalf, but it is recommended that you make a last inspection of the property before completion of the transaction takes place. It is also possible that there may be last minute amendments to the ”acte de vente”.

- On completion day, the final balance of the purchase price is paid, you are given the keys to the property and an “attestation de vente”. Registration of ownership can take up to 6 months to complete.

- You must organise insurance from the date of completion, and sort out reading meters and getting service contracts with utility providers.

For further information please contact Sarah Bogard.

CLICK TO VISIT |

Your French Matters17 rte. du Grallet

17920 - BREUILLET | Laura MORLEY

Telephone: 06 79 14 21 03

yourfrenchmatters@gmail.com

|

Help and Advice for all your Professional and Personal Administrative Matters

I have lived with my family in France for eight years. We began our adventure in the Charente area of France but relocated to the Charente Maritime and the coast in 2006. In the UK, I was a primary school teacher and upon moving to France studied and gained a diploma with honours to Teach English as a Foreign Language (TEFL).

As well as giving English lessons to French individuals, I had my own retail enterprise and have spent 4 years in a chartered Accountancy firm as head of the foreign section, completing over 200 income tax declarations annually and dealing with all administrative issues encountered by the UK expatriate in France.

Local Taxes: I have studied local tax impositions and verification of the French Tax Foncière and Tax d’Habitation in order to check that the tax impositions are based on realistic information and requesting recalculation when appropriate.

Business Setup: I give help and advice on grants and financial help available for business set up and personal situations with the CAF (social security and family allowance organisation in France).

I help people to understand, register and run their business under the micro regime and auto entrepreneur regime and help deal with the social organisations such as RSI and URSSAF.

Sworn Translations: I am a sworn translator via the TRIBUNAL DE GRANDE INSTANCE de SAINTES and have recently been awarded accreditation to complete and certify Capital gains declarations.

Tax Reimbursement: I also deal with obtaining reimbursement of tax paid twice for clients that relocate to France from the UK or other European countries and dealing with pension forecasts and other administrative issues involving the relocation from one country to another.

Works Undertaken: Annual French Income Tax returns (residents and non residents), Completion of UK administrative forms (P85, R105, France Individual etc), Help understanding Social charges and Social Contributions, Business registration and advice under the Micro regime or the Auto entrepreneur scheme, Issues surrounding local taxes such as Taxe Foncière & Taxe d'Habitation, Help with planning permissions, Certified and Sworn Translations (registration via the Tribunal in Saintes)

No matter how many books one reads or how much advice one seeks from others who have made the move to France sadly there are always pitfalls.

My customers save a great deal of time and stress by using my service, that's what they tell me, and I can see the relief on their faces. I am Rachel Gallard, a French National and I am tri-lingual; I also speak German fluently. Having lived and worked in the Channel Islands for many years I can understand the frustrations felt by my UK clients trying to deal with another culture, in particular - the French way.

The French approach to business and service can be hard to comprehend even for the French, so I have developed an accurate and up-to-date knowledge of the system, I spend my time ensuring the answers are in place before the questions arise.

Anglo‑French Communication is registered with the French authorities and as such is legally required to meet their standards in providing a legitimate and accurate service to customers.

Through Anglo‑French Communication my clients have easy access to other professionals who I trust and work with, here in Brittany. Even if your problem is utterly unique, you have our combined experience to draw on for a fast and effective solution to any headache.

The stories are true, every branch of the French civil service adores red tape and paperwork, let us handle the administration while you enjoy your new life in France!

We provide high quality services to individuals and all types of businesses paying close attention to the needs of each client.

Partners

Obligatory Health Insurance

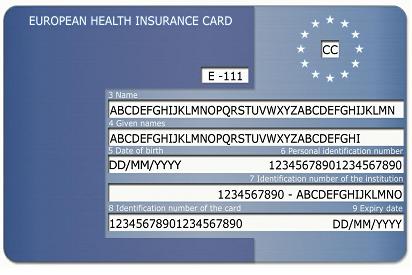

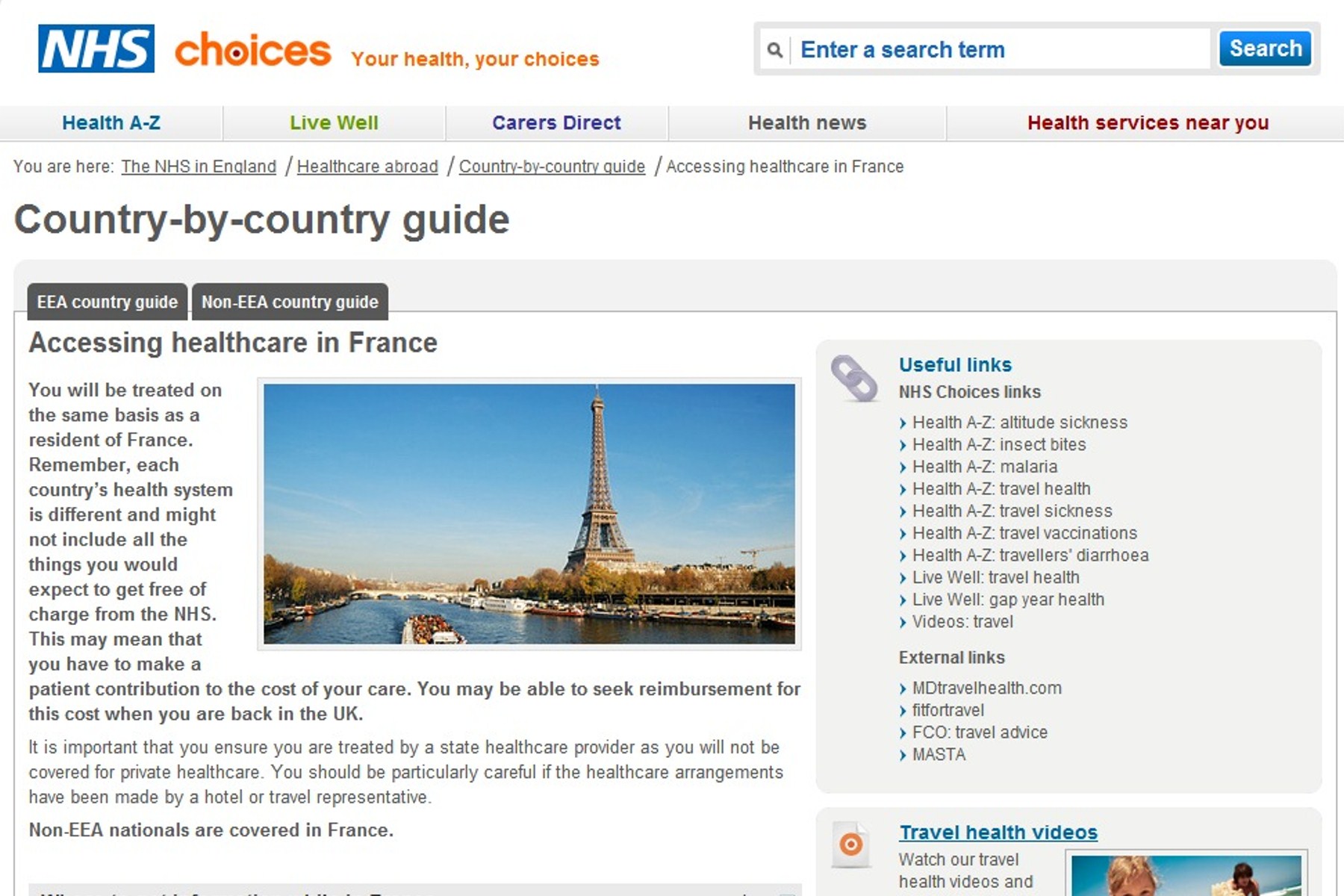

| National Health Service | Everyone will need to contact the NHS at one point.

It is the DWP that will issue your documents showing your reciprocal rights to French social security cover.

Even those with no rights will need to contact the DWP to obtain a document proving your ineligibility.

0044 (0) 191 218 (1999) or (7777) |

| Link to the "Accessing healthcare in France" NHS Official page. |

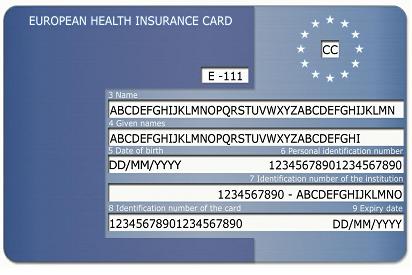

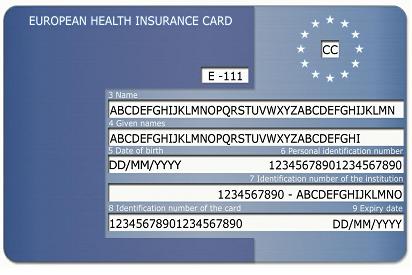

| The EHIC is entirely free of charge. However, other, unofficial, websites may charge you if you apply through them. If you're having difficulties with the online application form, to update your personal details, or to replace a lost or stolen card, call the automated EHIC application service on 0845 606 2030. |

| Caisse Primaire d'Assurance Maladie | French equivalent to the NHS.

French Social security for salaried workers.

If you are employed in France, your employer must contribute to your health cover.

People still in possession of international rights must register with their local CPAM office.

Contact the English help line on 0811 36 36 46 |

| Regime Social des Independants. | French Social security for self-employed workers. NB. RSI is the administrative umbrella and will not reimburse medical treatment. Reimbursements come from a third-party called "Régime Obligatoire" (R.O.) that you must choose upon registration of your activity.

When choosing your RO. bare in mind that some of the smaller or local ones do not have the "TELETRANSMITION" facility with the Top-Ups.

This will not alter your rights but you will have to send off paperwork to get reimbursed. |

| Couverture Maladie Universelle. | French Social security for people without valid “S1” forms who are no longer active and/or often have limited or no resources. The CMU will grant access to the CPAM provided that you have lived in France for more than five years or possibly less in case of unplanned eventualities. English helpline – 0811 363 646 |

Partners

Health cover in France - How does it work ?

-

HOW DOES IT WORK

Know your number off by heart !

In the event that you are taken ill without you personal

belongings, just by telling you "numéro de Sécurité Sociale"

the medical services will have enough information to get started.

The first number designates your sex, 1 for men and 2 for women.

For temporary numbers starting with 5, 6, 7 or 8 this logic does not apply.

The next four numbers indicate your year and month of birth.

Your "insee" number will probably be followed by 99 for foreigners.

This number is replaced by the department code if you were born in France.

e.g.: 24 if you were born in the Dordogne.

Finally, a series of 8 numbers show what “CPAM” office treats your dossiers.

"How to use your "Carte Vitale" & "Top-Up"

When you have medical treatment in France, you are usually asked for your “CARTE VITALE” (from CPAM or RSI) and the slip of paper called “Tiers payant complémentaire or Mutuelle" (from your Top-Up). Usually no money is asked for. The bill will be sent to “CPAM” (Caisse Primaire d’Assurance Maladie or other if selfemployed) and your TOP-UP.

When only your Carte Vitale is asked for this is usually because there is the possibility of using the “Télétransmission” (automatic payment and reimbursement system). You will have to pay either the total amount (eg: GP, Dentist) or just the “Ticket Modérateur” difference between the CPAM allowance and the “Tarif de convention” (100%

base rate (what the state says your treatment is worth).

CPAM will proceed with their partial reimbursement and send the information(normally) to your Top-Up by Télétransmission.

Your Top-Up will in turn reimburse the difference depending on your chosen level of cover.

In some cases you will have to pay for excess charges that the “Médecin Spécialiste” has over the state convention rate. These are called in French “Dépassements d’honoraires”.

These charges can be claimed from your Top-up by sending the an acquitted bill. (! If your level of guarantee covers such charges).

If the CPAM does not reimburse medical treatment then the Top-up will not either, unless otherwise stated by annual flat rate.

(eg: Private room, glasses, spa, flu injection, etc.)

How to use "Feuille de Soins" or "Factures"

When your “Carte Vitale” is not used, papers called “FEUILLES DE SOINS” are given to you.

The information on these papers is identical to the information given by your “Carte Vitale”.

These forms have to be filled in and sent to the CPAM office dealing with your reimbursements.

! Please make sure you fill in your Social security number (also called numéro d’immatriculation) and sign the paperwork at the bottom.

If for whatever reason the Top-up takes time reimbursing their part on reception of the CPAM statement itemising your last reimbursements, send these to your Top-up.

(This replaces the Télétransmission should CPAM not have sent the information in the first place).

As soon as your Top-up has the correct information they too can reimburse their part.

N.B: If you send your paperwork directly to your insurance company, then the reimbursements will be a lot quicker than if you send them to your brokers, “SOFICA’s”. Please, do not forget to indicate your contract number.

Partners

Top-Up health insurance

ASAF/AFPS/GIEPS

950 route des Colles

Les Templiers

06410 - BIOT

ASAF (Association Santé et Action Familiale)

AFPS (Action Familiale de Prévoyence Sociale)

Established in 1974 with the objective of making accessible, Top-Up health covers to everyone, whatever their age, their personal situation or their particular health needs.

ASAF’s human resources and technical dispositions are supported by GIEPS (Groupement d'Intérêt Économique de Prévoyance Sociale) this gives us the possibility to maintain a sensibly sized structure with around 180 employees offering to adherents the best possible services.

At the end of 2010, ASAF & AFPS had 251 000 members.

The reputation of secure insurer since the beginning, the group contract with AXA guaranteed financial solidarity to the durability to ASAF.

Top-Up, Régime Complémentaire or Mutuelle.

Most medical treatments are only partially covered by the régime obligatoire and some not at all. It is French way of life to take out an additional insurance that works hand-in-glove with the French regime obligatoires to reduce or eliminate such shortfalls.

Different levels of cover, adapted to different needs and especially for different budgets. It is important to understand that French Top-Ups are designed to cover expensive unplanned medical bills incurred during treatment and not just to get a new set of dentures. Unlike any other insurance, it is not because one person makes a claim that their premiums will increase. Effectively in comparison, you could say that people in good health pay for people in need of treatment. The Top-Up system is based on “solidarity” like the CPAM. To stop your premiums shooting through the roof should you fall seriously ill, the costs will spread out annually to all clients, thus making Top-Up insurance accessible to everyone. Those that are unable to afford Top-Up are granted help from the government called ACS to contribute towards a Top-Up proving how important it is to take out such insurance.

Top-Ups starts at 100% of the base de convention and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICAS recommends middle of the range cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for other medical treatment as some base rates are very low.

Partners

ADMINISTRATIVE MATTERS

CLICK TO VISIT |

Furley Page Solicitors

39 St Margaret's Street

Canterbury

Kent

CT12TX

|

Sarah Bogard: 0044 (0) 1227 763 939

Florence Richards: 0044 (0) 1227 763 939

Anna Berry :0044 (0) 1227 763 939

|

The Basics of Buying French Property

- The process of buying French property is quite different to buying a property in the UK.

- Having a survey done is not obligatory, but recommended because the French property is “vendue en l’état” (sold as seen) which means that you take the property with any hidden defects which you could have discovered by searches or inspections.

- The price, sale of any chattels (furniture etc) and conditions of the contract are agreed with the seller.

- The seller produces a set of reports for you known as the “Dossier Diagnostique Technique”.

The obligatory reports, depending on age and location of property, include those on the presence of asbestos, termites, lead in the paintwork, and risks in the local area (such as flooding or landslides). For co-ownership properties (“copropriété”) will also be included a report confirming the size of the property to be sold if it is more than 8 square metres. Note that reports have only a certain length of validity (e.g. termites report is only valid for 6 months) so check the dates of the reports carefully. You can also make your own enquiries at the “Mairie” (town hall) to find out if an area is susceptible to termites or environmental risks etc.

- The process quickly moves to the signing of the first contract (“compromis de vente”) at which point a deposit (usually 5-10% of purchase price) is paid. This is a binding contract.

The “compromis de vente” is either drawn up by the estate agent in charge of the sale, or the notaire is instructed to draft it. This document contains a lot of information about the property and the surrounding area. It includes conditions precedent (“conditions suspensives”), which must be fulfilled in order for completion to take place. There are standard conditions that are included (such as the condition that the title deeds do not show any charges registered on the property other than those that will be paid from the sale proceeds) but sometimes it is advisable to include others. For example, if you want to develop the land you could request a condition that planning permission (or preliminary permission) is granted before you can complete to ensure you can do what you intend with the property.

- If you are a “non-professional” purchasing a residential property or land for residential construction, you benefit from a 7 day cooling off period after having signed the “compromis de vente”. If you decide that you no longer wish to purchase the property, you can serve notice on the seller. There is a very short time limit and if you have any concerns about the property you should ideally resolve them before signing the contract.

- You should investigate mortgage options at an early stage. If you decide to apply for a mortgage, it will be a condition of the sale that you obtain a mortgage offer, but you must comply with strict time frames for your application in order to benefit from this condition.

- It usually takes about 2 to 3 months between signature of the “compromis de vente” and the completion deed (“acte de vente”). During this time, the notaire carries out his searches and you get your mortgage arranged. The notaire will then confirm the date of completion.

Please note that the notaire represents both the seller and the buyer and he acts impartially. You are free to appoint your own notaire, at no additional cost as the notaires have to share the fees between them. The notaire’s fees are calculated on a set scale (not freely negotiated with you) based on the value of the property. The notaire’s fees are usually paid by the buyer. The notaire will hold the purchase funds in an account pending completion. You must ensure that the funds are paid to a designated account, and it is preferable to pay to the notaire rather than the estate agent. It is recommended that you get legal advice on how best to structure your legal ownership of the property, taking into account various inheritance rules on death and inheritance tax.

- You can give power to attorney to someone to sign on your behalf, but it is recommended that you make a last inspection of the property before completion of the transaction takes place. It is also possible that there may be last minute amendments to the ”acte de vente”.

- On completion day, the final balance of the purchase price is paid, you are given the keys to the property and an “attestation de vente”. Registration of ownership can take up to 6 months to complete.

- You must organise insurance from the date of completion, and sort out reading meters and getting service contracts with utility providers.

For further information please contact Sarah Bogard.

CLICK TO VISIT |

Your French Matters17 rte. du Grallet

17920 - BREUILLET | Laura MORLEY

Telephone: 06 79 14 21 03

yourfrenchmatters@gmail.com

|

Help and Advice for all your Professional and Personal Administrative Matters

I have lived with my family in France for eight years. We began our adventure in the Charente area of France but relocated to the Charente Maritime and the coast in 2006. In the UK, I was a primary school teacher and upon moving to France studied and gained a diploma with honours to Teach English as a Foreign Language (TEFL).

As well as giving English lessons to French individuals, I had my own retail enterprise and have spent 4 years in a chartered Accountancy firm as head of the foreign section, completing over 200 income tax declarations annually and dealing with all administrative issues encountered by the UK expatriate in France.

Local Taxes: I have studied local tax impositions and verification of the French Tax Foncière and Tax d’Habitation in order to check that the tax impositions are based on realistic information and requesting recalculation when appropriate.

Business Setup: I give help and advice on grants and financial help available for business set up and personal situations with the CAF (social security and family allowance organisation in France).

I help people to understand, register and run their business under the micro regime and auto entrepreneur regime and help deal with the social organisations such as RSI and URSSAF.

Sworn Translations: I am a sworn translator via the TRIBUNAL DE GRANDE INSTANCE de SAINTES and have recently been awarded accreditation to complete and certify Capital gains declarations.

Tax Reimbursement: I also deal with obtaining reimbursement of tax paid twice for clients that relocate to France from the UK or other European countries and dealing with pension forecasts and other administrative issues involving the relocation from one country to another.

Works Undertaken: Annual French Income Tax returns (residents and non residents), Completion of UK administrative forms (P85, R105, France Individual etc), Help understanding Social charges and Social Contributions, Business registration and advice under the Micro regime or the Auto entrepreneur scheme, Issues surrounding local taxes such as Taxe Foncière & Taxe d'Habitation, Help with planning permissions, Certified and Sworn Translations (registration via the Tribunal in Saintes)

No matter how many books one reads or how much advice one seeks from others who have made the move to France sadly there are always pitfalls.

My customers save a great deal of time and stress by using my service, that's what they tell me, and I can see the relief on their faces. I am Rachel Gallard, a French National and I am tri-lingual; I also speak German fluently. Having lived and worked in the Channel Islands for many years I can understand the frustrations felt by my UK clients trying to deal with another culture, in particular - the French way.

The French approach to business and service can be hard to comprehend even for the French, so I have developed an accurate and up-to-date knowledge of the system, I spend my time ensuring the answers are in place before the questions arise.

Anglo‑French Communication is registered with the French authorities and as such is legally required to meet their standards in providing a legitimate and accurate service to customers.

Through Anglo‑French Communication my clients have easy access to other professionals who I trust and work with, here in Brittany. Even if your problem is utterly unique, you have our combined experience to draw on for a fast and effective solution to any headache.

The stories are true, every branch of the French civil service adores red tape and paperwork, let us handle the administration while you enjoy your new life in France!

We provide high quality services to individuals and all types of businesses paying close attention to the needs of each client.

Partners

Obligatory Health Insurance

| National Health Service | Everyone will need to contact the NHS at one point.

It is the DWP that will issue your documents showing your reciprocal rights to French social security cover.

Even those with no rights will need to contact the DWP to obtain a document proving your ineligibility.

0044 (0) 191 218 (1999) or (7777) |

| Link to the "Accessing healthcare in France" NHS Official page. |

| The EHIC is entirely free of charge. However, other, unofficial, websites may charge you if you apply through them. If you're having difficulties with the online application form, to update your personal details, or to replace a lost or stolen card, call the automated EHIC application service on 0845 606 2030. |

| Caisse Primaire d'Assurance Maladie | French equivalent to the NHS.

French Social security for salaried workers.

If you are employed in France, your employer must contribute to your health cover.

People still in possession of international rights must register with their local CPAM office.

Contact the English help line on 0811 36 36 46 |

| Regime Social des Independants. | French Social security for self-employed workers. NB. RSI is the administrative umbrella and will not reimburse medical treatment. Reimbursements come from a third-party called "Régime Obligatoire" (R.O.) that you must choose upon registration of your activity.

When choosing your RO. bare in mind that some of the smaller or local ones do not have the "TELETRANSMITION" facility with the Top-Ups.

This will not alter your rights but you will have to send off paperwork to get reimbursed. |

| Couverture Maladie Universelle. | French Social security for people without valid “S1” forms who are no longer active and/or often have limited or no resources. The CMU will grant access to the CPAM provided that you have lived in France for more than five years or possibly less in case of unplanned eventualities. English helpline – 0811 363 646 |

Partners

Expaps In French Health Cover Lottery

Expats in French Health Cover Lottery

Tuesday 15 June 2010

Our recent exclusive on the EU investigation of French health rules provoked an interesting reaction from both readers and health insurance professionals.

One of the widely made comments concerned the difficulties faced by those with a pre-existing medical condition, both amongst those hoping to relocate to France and already resident.

Chris from Worcester wrote to us advising that he is planning to relocate to France, but due a recent stomach operation was concerned that he might not be able to find private health insurance.

‘When we do relocate we will have a modest income, so we cannot afford to pay large sums each year for health insurance,’ he stated.

Some of you had also applied for to get private health insurance, and had been turned down.

Adrian Metcalfe stated that he suffers from high blood pressure, for which he is undertaking medical treatment to keep it under control, but that was enough for the private insurer to whom he made application to turn down his request for health cover.

‘The result is that we fear we may actually have to return to the UK, as there is no way we can stay in France without having some form of health cover.’

However, it does seem all is not lost for those with a pre-existing medical condition.

Tony Mason of Soficas insurance brokers in

Bordeaux states that for those with a medical condition there is a

route of entry into the French system.

'If someone makes an application to us for insurance, and we

refuse due to a pre-existing medical condition, we will provide the applicant

with a letter that they can use to make application for entry into the CMU', he

stated.

'Under the rules of entry, those who are resident in France through

an E form, can make application to join the CMU when their cover expires,

provided they have been refused private health insurance.

''Indeed, we have numerous applicants who have taken precisely

this route and they have been successful.

''The only downside is that it is unlikely in the future you

would be able to obtain a mortgage or secured credit in France, as your

application for life insurance would probably be refused', he stated.

Strictly speaking, admission to the Couverture Maladie

Universelle (CMU) because of the refusal of private health insurance only

applies to those who developed a medical condition after they relocated to

France, although it is clear the local health authorities are not necessarily

applying this interpretation of the rules.

Given the unclear position, Peter Owen of Expathealthdirect.co.uk says people need to act with caution: 'If you are affiliated via E106 and during this period you have an illness and subsequent claims relating to this condition were excluded by a private insurer, then on expiry of the E106 it is possible, even probable, affiliation via the CMU would be granted, as a CPAM would judge this an accident de vie.'

'But', he continued, 'it is less certain if affiliation via CMU would be extended on expiry of E106 if you arrive in France with a pre-existing condition. A CPAM office could well argue this is no accident de vie at all, and may (harshly) judge this as somebody engaged in medical tourism, which the new rules intended to extinguish.'

In his view: 'Individual CPAM offices have always varied in their interpretation of regulations; it is a fact of life. As a result I would never advise a client that once an E106 has expired, affiliation via CMU would be automatically extended because of a pre-existing condition being excluded by a private insurer.'

Lack of Consistency in Rules

The differences in intrepretation of the rules was also commented on by a number of readers.

Thus, several months ago we heard from Jane Stewart in the Dordogne who told us that she was unable to obtain private health insurance as a result of an illness developed in France, but she received a blank refusal from her local CPAM for health cover.

At the time, we advised her to appeal against that decision, as is her right.

Following our article, she wrote to us last week to say: 'My application did not even go to the appeal panel, as the local CPAM director simply decided to sign off the application for me to be admitted to the Couverture Maladie Universelle (CMU)!'

A similar picture emerged from a conversation with Ron Wright of Exclusive Healthcare who pointed out to us that, in his experience several expats he had come across had actually been admitted to the CMU, even though they did not qualify under the rules of the French government circular of 23 November, 2007.

‘I know of three cases in three different health authority areas where the local CPAM have decided to admit them into the CMU, purely on the basis that they had been resident in France for more than 3 months in a stable and regular manner and had no other health cover', he stated.

‘There seems not rhythm or reason why this should have happened, and it all seems a bit of a post-code lottery. CPAMs seem to be making up their own rules, with some taking a hard line and others willing to admit you.'

David Yeates, Editor at www.french-property.com/news

Partners

Health cover in France - How does it work ?

-

HOW DOES IT WORK

Know your number off by heart !

In the event that you are taken ill without you personal

belongings, just by telling you "numéro de Sécurité Sociale"

the medical services will have enough information to get started.

The first number designates your sex, 1 for men and 2 for women.

For temporary numbers starting with 5, 6, 7 or 8 this logic does not apply.

The next four numbers indicate your year and month of birth.

Your "insee" number will probably be followed by 99 for foreigners.

This number is replaced by the department code if you were born in France.

e.g.: 24 if you were born in the Dordogne.

Finally, a series of 8 numbers show what “CPAM” office treats your dossiers.

"How to use your "Carte Vitale" & "Top-Up"

When you have medical treatment in France, you are usually asked for your “CARTE VITALE” (from CPAM or RSI) and the slip of paper called “Tiers payant complémentaire or Mutuelle" (from your Top-Up). Usually no money is asked for. The bill will be sent to “CPAM” (Caisse Primaire d’Assurance Maladie or other if selfemployed) and your TOP-UP.

When only your Carte Vitale is asked for this is usually because there is the possibility of using the “Télétransmission” (automatic payment and reimbursement system). You will have to pay either the total amount (eg: GP, Dentist) or just the “Ticket Modérateur” difference between the CPAM allowance and the “Tarif de convention” (100%

base rate (what the state says your treatment is worth).

CPAM will proceed with their partial reimbursement and send the information(normally) to your Top-Up by Télétransmission.

Your Top-Up will in turn reimburse the difference depending on your chosen level of cover.

In some cases you will have to pay for excess charges that the “Médecin Spécialiste” has over the state convention rate. These are called in French “Dépassements d’honoraires”.

These charges can be claimed from your Top-up by sending the an acquitted bill. (! If your level of guarantee covers such charges).

If the CPAM does not reimburse medical treatment then the Top-up will not either, unless otherwise stated by annual flat rate.

(eg: Private room, glasses, spa, flu injection, etc.)

How to use "Feuille de Soins" or "Factures"

When your “Carte Vitale” is not used, papers called “FEUILLES DE SOINS” are given to you.

The information on these papers is identical to the information given by your “Carte Vitale”.

These forms have to be filled in and sent to the CPAM office dealing with your reimbursements.

! Please make sure you fill in your Social security number (also called numéro d’immatriculation) and sign the paperwork at the bottom.

If for whatever reason the Top-up takes time reimbursing their part on reception of the CPAM statement itemising your last reimbursements, send these to your Top-up.

(This replaces the Télétransmission should CPAM not have sent the information in the first place).

As soon as your Top-up has the correct information they too can reimburse their part.

N.B: If you send your paperwork directly to your insurance company, then the reimbursements will be a lot quicker than if you send them to your brokers, “SOFICA’s”. Please, do not forget to indicate your contract number.

Partners

Top-Up health insurance

ASAF/AFPS/GIEPS

950 route des Colles

Les Templiers

06410 - BIOT

ASAF (Association Santé et Action Familiale)

AFPS (Action Familiale de Prévoyence Sociale)

Established in 1974 with the objective of making accessible, Top-Up health covers to everyone, whatever their age, their personal situation or their particular health needs.

ASAF’s human resources and technical dispositions are supported by GIEPS (Groupement d'Intérêt Économique de Prévoyance Sociale) this gives us the possibility to maintain a sensibly sized structure with around 180 employees offering to adherents the best possible services.

At the end of 2010, ASAF & AFPS had 251 000 members.

The reputation of secure insurer since the beginning, the group contract with AXA guaranteed financial solidarity to the durability to ASAF.

Top-Up, Régime Complémentaire or Mutuelle.

Most medical treatments are only partially covered by the régime obligatoire and some not at all. It is French way of life to take out an additional insurance that works hand-in-glove with the French regime obligatoires to reduce or eliminate such shortfalls.

Different levels of cover, adapted to different needs and especially for different budgets. It is important to understand that French Top-Ups are designed to cover expensive unplanned medical bills incurred during treatment and not just to get a new set of dentures. Unlike any other insurance, it is not because one person makes a claim that their premiums will increase. Effectively in comparison, you could say that people in good health pay for people in need of treatment. The Top-Up system is based on “solidarity” like the CPAM. To stop your premiums shooting through the roof should you fall seriously ill, the costs will spread out annually to all clients, thus making Top-Up insurance accessible to everyone. Those that are unable to afford Top-Up are granted help from the government called ACS to contribute towards a Top-Up proving how important it is to take out such insurance.

Top-Ups starts at 100% of the base de convention and can go up to 600% or more depending on your needs and especially what area you live in.

SOFICAS recommends middle of the range cover, around 200% for hospitalization permitting you to use Doctors charging twice the "Tarif de Convention“ but lower for other medical treatment as some base rates are very low.

Partners

ADMINISTRATIVE MATTERS

CLICK TO VISIT |

Furley Page Solicitors

39 St Margaret's Street

Canterbury

Kent

CT12TX

|

Sarah Bogard: 0044 (0) 1227 763 939

Florence Richards: 0044 (0) 1227 763 939

Anna Berry :0044 (0) 1227 763 939

|

The Basics of Buying French Property

- The process of buying French property is quite different to buying a property in the UK.

- Having a survey done is not obligatory, but recommended because the French property is “vendue en l’état” (sold as seen) which means that you take the property with any hidden defects which you could have discovered by searches or inspections.

- The price, sale of any chattels (furniture etc) and conditions of the contract are agreed with the seller.

- The seller produces a set of reports for you known as the “Dossier Diagnostique Technique”.

The obligatory reports, depending on age and location of property, include those on the presence of asbestos, termites, lead in the paintwork, and risks in the local area (such as flooding or landslides). For co-ownership properties (“copropriété”) will also be included a report confirming the size of the property to be sold if it is more than 8 square metres. Note that reports have only a certain length of validity (e.g. termites report is only valid for 6 months) so check the dates of the reports carefully. You can also make your own enquiries at the “Mairie” (town hall) to find out if an area is susceptible to termites or environmental risks etc.

- The process quickly moves to the signing of the first contract (“compromis de vente”) at which point a deposit (usually 5-10% of purchase price) is paid. This is a binding contract.

The “compromis de vente” is either drawn up by the estate agent in charge of the sale, or the notaire is instructed to draft it. This document contains a lot of information about the property and the surrounding area. It includes conditions precedent (“conditions suspensives”), which must be fulfilled in order for completion to take place. There are standard conditions that are included (such as the condition that the title deeds do not show any charges registered on the property other than those that will be paid from the sale proceeds) but sometimes it is advisable to include others. For example, if you want to develop the land you could request a condition that planning permission (or preliminary permission) is granted before you can complete to ensure you can do what you intend with the property.

- If you are a “non-professional” purchasing a residential property or land for residential construction, you benefit from a 7 day cooling off period after having signed the “compromis de vente”. If you decide that you no longer wish to purchase the property, you can serve notice on the seller. There is a very short time limit and if you have any concerns about the property you should ideally resolve them before signing the contract.

- You should investigate mortgage options at an early stage. If you decide to apply for a mortgage, it will be a condition of the sale that you obtain a mortgage offer, but you must comply with strict time frames for your application in order to benefit from this condition.

- It usually takes about 2 to 3 months between signature of the “compromis de vente” and the completion deed (“acte de vente”). During this time, the notaire carries out his searches and you get your mortgage arranged. The notaire will then confirm the date of completion.

Please note that the notaire represents both the seller and the buyer and he acts impartially. You are free to appoint your own notaire, at no additional cost as the notaires have to share the fees between them. The notaire’s fees are calculated on a set scale (not freely negotiated with you) based on the value of the property. The notaire’s fees are usually paid by the buyer. The notaire will hold the purchase funds in an account pending completion. You must ensure that the funds are paid to a designated account, and it is preferable to pay to the notaire rather than the estate agent. It is recommended that you get legal advice on how best to structure your legal ownership of the property, taking into account various inheritance rules on death and inheritance tax.

- You can give power to attorney to someone to sign on your behalf, but it is recommended that you make a last inspection of the property before completion of the transaction takes place. It is also possible that there may be last minute amendments to the ”acte de vente”.

- On completion day, the final balance of the purchase price is paid, you are given the keys to the property and an “attestation de vente”. Registration of ownership can take up to 6 months to complete.

- You must organise insurance from the date of completion, and sort out reading meters and getting service contracts with utility providers.

For further information please contact Sarah Bogard.

CLICK TO VISIT |

Your French Matters17 rte. du Grallet

17920 - BREUILLET | Laura MORLEY

Telephone: 06 79 14 21 03

yourfrenchmatters@gmail.com

|

Help and Advice for all your Professional and Personal Administrative Matters

I have lived with my family in France for eight years. We began our adventure in the Charente area of France but relocated to the Charente Maritime and the coast in 2006. In the UK, I was a primary school teacher and upon moving to France studied and gained a diploma with honours to Teach English as a Foreign Language (TEFL).

As well as giving English lessons to French individuals, I had my own retail enterprise and have spent 4 years in a chartered Accountancy firm as head of the foreign section, completing over 200 income tax declarations annually and dealing with all administrative issues encountered by the UK expatriate in France.

Local Taxes: I have studied local tax impositions and verification of the French Tax Foncière and Tax d’Habitation in order to check that the tax impositions are based on realistic information and requesting recalculation when appropriate.

Business Setup: I give help and advice on grants and financial help available for business set up and personal situations with the CAF (social security and family allowance organisation in France).

I help people to understand, register and run their business under the micro regime and auto entrepreneur regime and help deal with the social organisations such as RSI and URSSAF.

Sworn Translations: I am a sworn translator via the TRIBUNAL DE GRANDE INSTANCE de SAINTES and have recently been awarded accreditation to complete and certify Capital gains declarations.

Tax Reimbursement: I also deal with obtaining reimbursement of tax paid twice for clients that relocate to France from the UK or other European countries and dealing with pension forecasts and other administrative issues involving the relocation from one country to another.

Works Undertaken: Annual French Income Tax returns (residents and non residents), Completion of UK administrative forms (P85, R105, France Individual etc), Help understanding Social charges and Social Contributions, Business registration and advice under the Micro regime or the Auto entrepreneur scheme, Issues surrounding local taxes such as Taxe Foncière & Taxe d'Habitation, Help with planning permissions, Certified and Sworn Translations (registration via the Tribunal in Saintes)

No matter how many books one reads or how much advice one seeks from others who have made the move to France sadly there are always pitfalls.

My customers save a great deal of time and stress by using my service, that's what they tell me, and I can see the relief on their faces. I am Rachel Gallard, a French National and I am tri-lingual; I also speak German fluently. Having lived and worked in the Channel Islands for many years I can understand the frustrations felt by my UK clients trying to deal with another culture, in particular - the French way.

The French approach to business and service can be hard to comprehend even for the French, so I have developed an accurate and up-to-date knowledge of the system, I spend my time ensuring the answers are in place before the questions arise.

Anglo‑French Communication is registered with the French authorities and as such is legally required to meet their standards in providing a legitimate and accurate service to customers.

Through Anglo‑French Communication my clients have easy access to other professionals who I trust and work with, here in Brittany. Even if your problem is utterly unique, you have our combined experience to draw on for a fast and effective solution to any headache.

The stories are true, every branch of the French civil service adores red tape and paperwork, let us handle the administration while you enjoy your new life in France!

We provide high quality services to individuals and all types of businesses paying close attention to the needs of each client.

Partners

Obligatory Health Insurance

| National Health Service | Everyone will need to contact the NHS at one point.

It is the DWP that will issue your documents showing your reciprocal rights to French social security cover.

Even those with no rights will need to contact the DWP to obtain a document proving your ineligibility.

0044 (0) 191 218 (1999) or (7777) |

| Link to the "Accessing healthcare in France" NHS Official page. |